This publish could include affiliate hyperlinks and WPF could earn cash or merchandise from corporations talked about. Our visitor publish plugin stopped working! Please notice that the authors listed is probably not correct right here 🙁 Extra information

Heads up! Mint by Intuit shall be signing off in 2024. Whereas we’re bidding farewell to this previous monetary pal, it’s the right second to welcome new budgeting instruments that may assist us keep on high of our finance sport.

1. Empower

(the brand new face of Private Capital)

This one’s our favourite – and it received’t price you a dime. Empower delivers a robust overview of your funds with out the value tag. Certain, they could pitch their asset administration companies, however there’s no catch. You’ll be able to sidestep the pitches and nonetheless profit from the distinctive instruments they provide.

2. You Want A Funds (YNAB)

Concern not! We’ve curated a listing of stellar alternate options, with some unique WPF free trial perks:

For the meticulous budgeter in you, YNAB provides a sensible method to provide each greenback its mission. It’s excellent for these able to get hands-on with their money circulation. Plus, use our WPF hyperlink to get pleasure from a 34-day free trial and really feel the distinction firsthand.

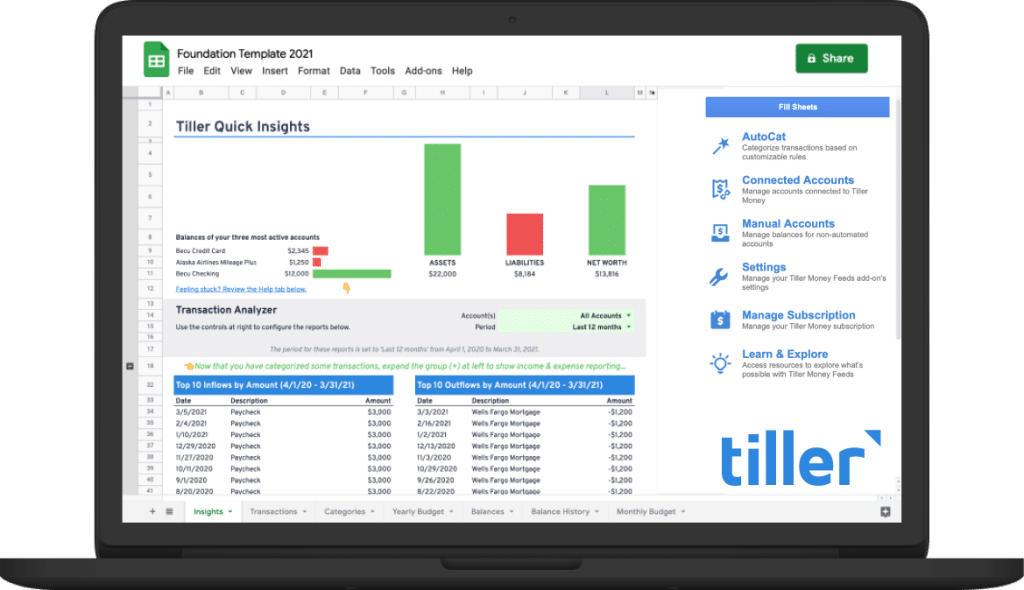

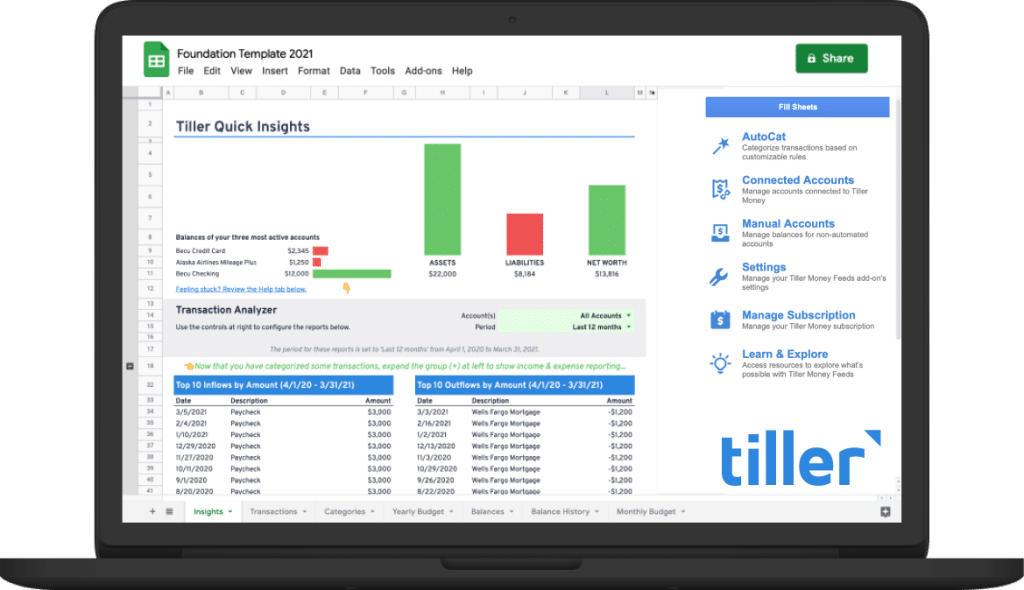

3. Tiller

Spreadsheet wizards, rejoice! Tiller takes your monetary knowledge and places it to work in customizable Google Sheets, providing a 30-day free trial to get your sheets so as. It’s the last word management heart for many who love a personal touch of their monetary monitoring.

Budgeting is Higher with Help!

| As we navigate this alteration, do not forget that our group power lies in sharing and supporting. We’re excited to listen to in regards to the instruments you select and the brand new budgeting paths you’ll discover.

Wishing you seamless transitions and empowered budgeting! P.S. We’ve received a channel devoted particularly to YNAB over on Woven. Change into a Mission Supporter and acquire entry to talk with different WPF’rs about how they use YNAB! |