I’ve all the time cherished sports activities, enjoying tennis and cricket after I was rising up, earlier than transitioning to fan standing, cheering for my favored groups from the sidelines. I additionally like finance, maybe not as a lot as sports activities, however there are winners and losers within the funding sport as nicely. Thus, it ought to come as no shock that when the 2 join, as is the case when groups are purchased and offered, or gamers are signed, I’m doubly . The time is ripe now to speak about how skilled sports activities, in its many variations all over the world, has blown a monetary gasket, as you see groups offered for costs that appear out of sync with their monetary fundamentals and gamers signed on contracts that equate to the GDP of a small nation. On this submit, that’s my goal, and if get sidetracked, as a sports activities followers, I apologize upfront.

The Lead In

In its idealistic kind, sports activities is about competitors and the human spirit, and is divorced from cash. That was the best behind not simply the Olympic ban on athletes from being paid for performing, but in addition behind main tennis tournaments being restricted to only amateurs till 1968 and all the collegiate sports activities scene. Each restrictions ultimately fell, laden by hypocrisy, for the reason that similar entities that preached the significance of retaining cash out of sports activities, and insisted that the gamers on the sector couldn’t make a dwelling from enjoying it, engorged themselves on its financial spoils. At this level, it appears simple that sports activities and cash are entwined, and that attempting to separate the 2 is pointless.

The Story Traces

Because the partitions between sports activities and cash have crumbled, we now have change into used to seeing mind-boggling numbers on sports activities transactions, whether or not or not it’s within the kind on broadcasting networks paying for the rights to hold sporting occasions or participant contracts pushing into the a whole bunch of hundreds of thousands. Even by these requirements, although, the previous few months have delivered surprises which have staggered even essentially the most jaded sports-watchers:

- Participant contracts: Whereas participant contracts have change into larger over time, the $776 million supply by Al-Hilal, a Saudi crew, to Kylian Mbappe, the French celebrity on contract with PSG, for a one-year contract to play with the crew was eye-popping in magnitude. Whereas Mbappe turned down the supply and is contemplating a ten-year take care of PSG, the numbers concerned within the Al-Hilal deal are virtually inconceivable to justify on purely financial phrases. In parallel, because the 2023 baseball season winds down, questions on which crew would signal Shohei Ohtani, its greatest participant, and for how a lot have been extensively debated within the media.

- Sports activities franchise transactions: In 2023, the Washington Commanders, an NFL crew with a decidedly blended document on the sector and a historical past of controversy round its identify and proprietor, was offered for over $6 billion to a consortium, making it the best priced sports activities franchise transaction in historical past. It adopted a decade or extra of ever-rising costs for sports activities franchises all over the world, from the Premier League (soccer) within the UK, to the IPL (cricket) and throughout skilled sports activities within the US.

- Sport disruptions: The final yr has additionally introduced threats to sports activities franchises, placing at their very existence. The Saudi crew bid for Mbappe mirrored a broader try by the nation to disrupt skilled sports activities, with skilled golf, particularly, within the cross hairs. When LIV made its bid by signing up a few of the best-known golf gamers on the earth to play in its tournaments, few gave it an opportunity of success towards the PGA, however in 2023, it was the PGA that conceded the battle within the cash sport.

- Broadcasting upheaval: Because the revenues from sports activities has shifted from the enjoying fields to media, it’s the dimension of the media contracts that decide how profitable a sport is. In 2021, we noticed the NFL, the richest franchise on the earth, enter into new media contracts to cowl the subsequent decade of broadcasting rights for the game. These contracts aren’t solely anticipated to herald a staggering $114 billion in revenues to the NFL within the subsequent decade, however in a mirrored image of the occasions, they’re break up amongst 4 totally different broadcasters (ESPN, CBS, NBC and Fox), with Amazon Prime choosing up the slack. The growing significance of streaming within the media enterprise was illustrated when the IPL, India’s cricket league, offered its media rights for the subsequent 5 years for tv broadcasting to Star India, a Disney-owned subsidiary, for roughly $3 billion, and the streaming rights for a similar interval to Viacom18, a Reliance-controlled three way partnership, for about the identical quantity.

Whereas these tales cowl disparate elements of sports activities, and the one factor they share in frequent is the explosively giant monetary numbers, I’ll argue, on this submit, that they signify an acceleration in a phenomenon that may change how these sports activities will get performed and watched.

Rising Franchise Costs

Even an off-the-cuff follower of the information on sports activities franchises altering arms, it doesn’t matter what the game, will need to have observed the surge within the pricing of sports activities franchises, with little or no apparent connection to crew success on the sector; the Washington Commanders, the goal of $6 billion acquisition, have gained 63 video games, whereas shedding 97, within the final decade. In reality, the 5 highest costs paid for sports activities groups have all be paid within the final two years, as might be seen within the listing of ten costliest sports activities franchise transactions in historical past:

|

|

|

|

|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

These excessive costs, although, signify the continuation of a development that we now have seen over the previous few a long time in franchise pricing, with the graph beneath taking a look at each main sports activities transaction between 1998 and 2023:

As you’ll be able to see, transaction costs for sports activities franchises have been marching upwards for the final 20 years, with NBA and NFL groups registering the largest will increase, however have seen breakaway surges in the previous few years.

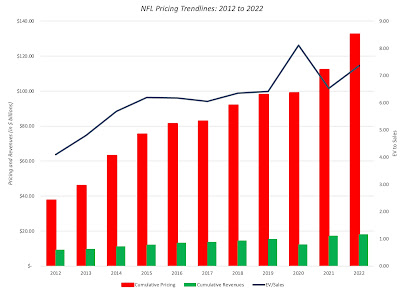

A few of it’s possible you’ll be aware of the Forbes annual listings of essentially the most priceless groups on the earth, and you could have puzzled how they worth sports activities groups. The reality, and I’ll make clear what I imply shortly, is that Forbes doesn’t worth sports activities franchises, however costs them. Since Forbes will get attracts on precise transaction costs as steering of their estimates, the pricing that Forbes attaches to groups has risen with transaction costs. Within the graph beneath, as an illustration, I report the cumulative pricing of all NFL groups, as estimated by Forbes, from 2012 to 2022:

The collective pricing of all NFL groups, based on Forbes, has risen from $37.6 billion in 2012 to $132.5 billion in 2022. In reality, I can be prepared to foretell that given the Washington Commanders transaction, the pricing of each NFL crew on the Forbes listing can be larger in 2023.

With the pricing course of in thoughts, it’s instructive to have a look at the collective pricing, in hundreds of thousands of US {dollars}, of worldwide sports activities franchises, as of the latest updates from 2022 and 2023:

| Cumulative Pricing (in $ mil) | Highest Priced | Lowest Priced | |

|---|---|---|---|

| NFL (US Soccer) | $132,500 | $7,640 | $4,140 |

| NBA (Basketball) | $85,910 | $7,000 | $1,600 |

| MLB (Baseball) | $69,550 | $7,100 | $1,000 |

| NHL (Hockey) | $32,350 | $2,200 | $450 |

| MLS (US Soccer) | $16,200 | $1,000 | $350 |

| Premier League (To twenty) | $30,255 | $5,950 | $145 |

| IPL (Indian Cricket) | $10,430 | $1,300 | $850 |

The NFL is essentially the most priceless franchise on the earth, when it comes to collective pricing of all of its groups, adopted by basketball and baseball. The collective pricing of all soccer groups all over the world may very well be near and even exceed the pricing of baseball or basketball groups, however simply the highest 20 Premier League groups have a pricing of about $30 billion. The ten groups that comprise the IPL, the Indian cricket league, have a collective pricing in extra of $10 billion. One fascinating distinction throughout franchises is the variations between the best and lowest priced franchises, with the NFL having the smallest distinction, and we’ll discuss how the best way broadcasting income are shared can clarify this divergence throughout sports activities franchises.

Lastly, there’s a subset of sports activities franchises which are publicly traded, however it’s a very small one. Amongst US sports activities franchises, the one which comes closes is Madison Sq. Backyard Sports activities, which along with proudly owning the world (Madison Sq. Backyard) additionally owns the New York Knicks (NBA) and the New York Rangers (hockey), however it’s carefully held, with the Dolan household firmly in management. Outdoors of the US, Manchester United is the highest-profile instance of a publicly traded firm, nevertheless it too is carefully held, with management within the arms of the Glazer household. There are just a few European soccer groups which are publicly traded, however all of them are typically carefully held, with gentle liquidity.

Worth vs Worth

In the event you discover me finicky, after I label the Forbes estimates for franchises as costs, fairly than values, it’s best understood by contrasting worth and worth, two phrases that, a minimum of to me, imply very various things and require totally different mindsets:

As you’ll be able to see from the image, whereas worth is pushed by acquainted fundamentals (money flows, progress and danger), worth is decided by demand and provide, which, in flip, are pushed by temper and momentum, behavioral elements that don’t play a key position in figuring out worth. I used this distinction, just a few years in the past, to categorise investments and discuss worth and worth with each:

As you’ll be able to see, collectibles and currencies can solely be priced, and whereas commodities might have an mixture elementary worth, they’re extra more likely to be priced than valued. It is just with property which are anticipated to generate cashflows sooner or later that worth even comes into play. An organization or a enterprise might be valued, and that worth will mirror its capability to generate money flows sooner or later, nevertheless it may also be priced, based mostly upon what others are paying for comparable corporations. In reality, virtually each funding philosophy might be framed when it comes to whether or not you imagine that there generally is a hole between worth and worth, and when there’s a hole, how rapidly it’s going to trigger, in addition to catalyst that trigger that closing.

There’s a sub-grouping of property, although, that’s value carving out and contemplating otherwise, and I’ll name these trophy property. A trophy asset has anticipated money flows, and might be valued like another asset, however the individuals who purchase it typically accomplish that, much less for its asset standing and extra as a collectible. Powered by emotional elements, the costs of trophy property can rise above values and keep larger, since, not like different property, there isn’t any catalyst that may trigger the hole between worth and worth to shut. So, what’s it that makes it for a “trophy property”?

- Emotional attraction overwhelms monetary traits: The important thing to a trophy asset is that the core of its attraction, to potential consumers or buyers, lies much less in enterprise fashions and money flows, and extra within the emotional attraction it has to consumers. That attraction could also be solely to a subset of people, however these consumers wish to personal the asset extra for the emotional dividends, not the cashflows.

- It’s distinctive: Trophy property pack a punch as a result of they’re distinctive, insofar as they can’t be replicated by somebody, even when that somebody has substantial monetary sources.

- It’s scarce: For trophy property to command a pricing that’s considerably larger than worth, they need to be scarce.

- It’s purchased and held for non-financial causes: If trophy property are opened up for bidding, the profitable bidder will virtually all the time be a person or entity that’s shopping for the asset extra for its historical past or provenance, not its monetary traits.

As soon as an asset crosses the edge to trophy standing, you’ll be able to anticipate the next to happen. First, it’s going to look overestimated, relative to monetary fundamentals (earnings, revenues, money flows), and relative to look group property that don’t take pleasure in the identical trophy standing. Second, and that is important, at the same time as worth will increase relative to worth, the mechanism that causes the hole to shut, typically stemming from a recognition that the you could have paid an excessive amount of for one thing, given its capability to generate earnings and money flows, will cease working. In spite of everything, if consumers worth trophy property based mostly upon their emotional connections, they’re getting into the transaction, understanding that they’ve paid an excessive amount of, and don’t care. Third, and this follows from the firs level, the forces that trigger the costs of trophy property to vary from interval to interval can have a weak or no relationship to the basics that might usually drive worth.

There may be an fascinating query of whether or not a publicly traded firm can purchase trophy standing, and whereas my reply, ten or twenty years in the past, would have been a fast no, I’ve to pause earlier than I reply it now. As lots of , I’ve tried to worth Tesla, based mostly upon my story for the corporate, and the anticipated money flows that emerge from that story, many occasions over the past decade. Whereas a few of the pushback has come from those that disagree with the contours of my story, and my expectations, a few of it has come from individuals who haven’t solely invested a big proportion of their wealth within the firm, however have finished so as a result of they wish to be a part of what they see as a historic disruptor, one that may upend the best way we not solely drive, however stay. The implication then is that Tesla will commerce at costs which are tough to justify, given the corporate’s financials, that it’ll appeal to a subset of buyers who obtain emotional dividends from proudly owning the inventory and that quick promoting the inventory, on the expectation that the hole will shut, can be a deadly train.

Sports activities Franchises as Trophy Belongings

When the Rooney household purchased the Pittsburg Steelers, now a storied franchise in essentially the most extremely priced sports activities league (NFL) is 1932 for $2,500, it was very probably that they have been shopping for it as a enterprise, hoping to generate sufficient in ticket gross sales to cowl their prices and earn a revenue. In spite of everything, soccer (a minimum of the American model) was a nascent sport, not extensively adopted, and with just some groups and no organized construction. In reality, you’ll be able to nonetheless view the Steelers as a enterprise, and worth them as such, however as we’ll argue on this part, that quantity will bear little resemblance to the $4 billion pricing that Forbes connected to the crew. In reality, sports activities franchises internationally have already change into, or are more and more on the pathway to changing into trophy property.

1. Costs disconnect from Fundamentals

To worth a sports activities franchise as a enterprise, it’s value analyzing how the revenues for franchises have developed over time. Till the final 50 years, virtually all the revenues for sports activities franchises got here from gate receipts collected from followers coming in to observe video games, and the meals and merchandise that these followers purchased, normally on the video games they attended. With tv getting into the image, and streaming augmenting it, the portion of revenues that sports activities franchises get from media has change into a bigger and bigger slice of the pie, as might be seen within the graph beneath, the place we have a look at gate receipts, media income and different (merchandizing and sponsorship) revenues for all US sports activities franchises between 2006 and 2022:

As you’ll be able to see, the general revenues for sports activities franchises has grown between 2006 and 2022, with 2020 being the COVID outlier, however a lot of that progress has come from the media slice of revenues, as gate receipts have flatlined. That is clearly not only a US phenomenon, and you’re seeing the identical course of play out in Europe (with soccer the large beneficiary) and in India (with cricket the winner).

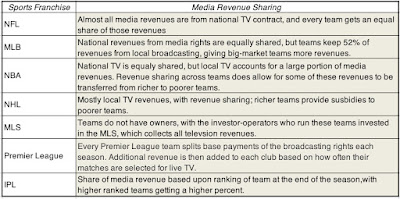

To worth a sports activities franchise, you not solely have to contemplate how a lot of a draw the crew is on the stadium, however how a lot revenues the crew will get from its media contracts, in addition to merchandising and sponsorship revenues. Whereas the gate receipts and merchandising revenues are important, they’re comparatively simple to forecast, given historical past and ticket gross sales. Media revenues, although, are tough, since they’re decided partly by the scale of the media market that the crew operates in, and partly by how the sports activities franchise that the crew belongs to shares its media revenues. Within the US, for instance, baseball groups get a good portion of their broadcasting revenues from native TV rights, and as a consequence, groups within the largest media markets (Yankees and Mets in New York, Dodgers in Los Angeles) have larger revenues than groups in smaller media market (Mariners in Seattle). In distinction, the media revenues for soccer (NFL) are principally nationwide, and people revenues are equally divided throughout the groups, leading to extra equitable media revenues throughout NFL groups. That distinction explains why the divergence between the best and lowest priced groups is larger in baseball than the NFL. The desk beneath supplies a comparability of how media revenues are shared throughout groups, by franchise:

Whereas all the franchises pay lip service to the necessity for steadiness, with giant media-market groups subsidizing small media-market groups, there may be vast variation throughout franchises in how they observe via on fixing that imbalance. Solely the NFL has a powerful sufficient system in place to create full steadiness, and that’s partly due to the truth that virtually all of its broadcasting revenues are nationwide (fairly than native) and partly as a result of it’s a league with a powerful commissioner.

Whereas revenues have risen, aided by richer broadcasting contracts, sports activities franchises have been confronted with rising participant prices; in virtually each main sports activities franchise in the US, participant bills account to 50% of revenues, or extra, they usually have risen over time. As soon as the opposite bills related to a crew are netted out, the working income at sports activities franchises are, for essentially the most half, average. Wanting throughout sports activities franchises, you’ll be able to see that the cumulated income and working revenue numbers, at the side of the collective pricing of groups (as estimated by Forbes) in the latest yr:

Whereas crew financials are typically opaque, Forbes estimated that the NFL, the richest sports activities franchise on the earth, generated about $4.7 billion in working revenue on revenues of roughly $16 billion, in 2022. The NBA is the next-most worthwhile franchise, whereas baseball collectively struggles to earn a living. Extra to the purpose, in case you use the Forbes pricing estimates for groups, notice that 4 of the seven franchises (NFL, NBA, MLS and IPL) commerce at 8-10 occasions revenues and at excessive multiples of working revenue. It’s true that there are tech corporations out there that commerce at comparable multiples, however these corporations have extraordinary progress potential forward of them and new markets to beat. Even in case you imagine that media rights will proceed to the the goose that lays the golden eggs for sports activities franchises, it’s tough to see the way you justify these pricing multiples. To point out that the disconnect between what consumers are paying for franchises, and what they’re getting again in return, has been rising over time, I have a look at the pricing of NFL groups over time, relative to revenues at these groups (which embody the richer media contracts) from 2012 to 2022:

During the last decade, you’ll be able to see that the pricing of NFL groups has risen from simply over 4 occasions revenues in 2012 to greater than seven occasions revenues in 2022. Briefly, NFL franchise costs are rising at charges that can’t be defined by income progress, richer media contracts however, or larger profitability.

2. A brand new breed of householders

At the beginning of this part, I discussed the Rooneys shopping for the Pittsburg Steelers in 1932 for $2,500, they usually proceed to personal the Steelers. Whereas it’s conceivable that they consider the Steelers as a enterprise they personal that has to proceed to ship earnings for them, a lot of the remainder of the NFL has seen a altering of the guard, with new homeowners changing the older holdouts. Many of those new homeowners are already rich, with their wealth collected in a unique setting (actual property, personal fairness, enterprise capital), after they purchase skilled sports activities groups, and from the outset, it appears clear that they’re much less all for turning a revenue , and extra in enjoying the position of crew proprietor. For instance, I give attention to the NBA, the place there was a lot turnover within the possession ranks, with near two-thirds of the groups buying new homeowners within the final 20 years:

As you browse this listing, you’ll notice that whereas most of the homeowners are billionaires, not counting their NBA crew possession, there are just a few homeowners, in direction of the underside of the listing, whose wealth is primarily of their crew possession. Searching for developments, the newer a sports activities franchise transaction, the extra probably it’s that the customer isn’t just rich, however immensely so, and this sample is enjoying out internationally.

So, why would these rich, and presumably financially savvy, people put their cash into sports activities groups? In step with the saying {that a} image is value a thousand phrases, check out this image of Steve Ballmer on the sidelines of a Clippers sport:

In some ways, sports activities franchises are the last word trophy property, since they’re scarce and proudly owning them not solely permits you to stay out your childhood desires, but in addition provides you an opportunity to indulge your family and friends, with front-row seats and participant introductions. In reality, it additionally explains the entry of sovereign wealth funds, particularly from the Center East, into the possession ranks, particularly within the Premier League. In the event you couple this actuality with the truth that winner-take-all economies of the twenty-first century ship extra billionaires in our midst, you’ll be able to see why there isn’t any imminent correction on the horizon for sports activities franchise pricing. So long as the variety of billionaires exceeds the variety of sports activities franchises on the face of the earth, it’s best to anticipate to see fewer and fewer homeowners just like the Rooneys and an increasing number of just like the Steves (Cohen and Ballmer).

Penalties of Trophy Asset Standing

In case you are a sports activities fan, it’s possible you’ll be questioning why any of this issues to you, since you aren’t a billionaire and aren’t planning to purchase any groups, both as companies or as trophy assts. I feel that it’s best to care as a result of the trophy asset phenomenon is already reshaping how groups are structured, sports activities get performed and maybe what your favourite crew will seem like subsequent yr, when it takes the sector.

- For House owners: For the homeowners of franchises that aren’t members of the billionaire membership, there can be strain to money out, and the important thing to getting a profitable supply is to extend the crew’s attraction to potential consumers, as toys. Including a high-profile participant, even one who’s approaching the tip of his or her enjoying life, can add to the attraction of a sports activities crew, as a trophy, even because it reduces its high quality on the sector, as is transferring to a metropolis {that a} potential purchaser might view as a greater setting for his or her costly toy (Oakland A’s and San Diego Clipper or Charger followers, take notice!). For billionaire homeowners of franchises, the reactions to proudly owning an costly toy that doesn’t carry out as anticipated, can vary from impatience with managers and gamers, to trades pushed by impulse fairly than sports activities sense.

- For Gamers: As sports activities franchises change into trophy property, gamers change into the jewels that add dazzle to those trophies. Not surprisingly, the superstars of each sport can be prized much more than they was once, not only for what they will do on the sector, however for what they will do for an proprietor’s bragging proper. The latest billion greenback bid for Mbappe and the upcoming bidding warfare for Shohei Ohtani make sense from this attitude, and it’s best to anticipate to see extra mind-glowingly giant participant contracts sooner or later. To the extent {that a} participant’s trophy attraction is as a lot a perform of that participant’s social media presence and following, as it’s of efficiency on the sector, it’s best to anticipate to see sports activities gamers aspire for celeb standing.

- For Followers: In case you are the fan of a sports activities franchise that’s owned by somebody to whom cash isn’t any object, you’ll have a lot to have a good time, as your crew chases down and indicators the largest names within the sport. As a unfavorable, in case your crew proprietor tires of their trophy asset, it’s possible you’ll be caught with the results of benign (or not so benign) neglect. If then again, you occur to be a fan of the crew that continues to be owned by an old-guard proprietor, intent on operating the crew as a enterprise, you will discover your self pissed off as homegrown stars get signed by different groups. The previous divide of wealthy groups/poor groups that was based mostly on unequal media markets or stadium sizes can be changed with a brand new divide between wealthy crew homeowners and poorer crew homeowners, the place the latter nonetheless need to make their groups work as companies, whereas the previous don’t.

In sum, in case your concern has been that sports activities has change into too business-like and pushed by knowledge, the entry of householders who’re much less within the enterprise of sports activities and extra all for buying trophies might very nicely change the sport, however at a value, the place sports activities turns into leisure, the place gamers and groups chase social media standing, and what occurs on the sector itself turns into secondary to what occurs off the pitch.

YouTube Video

Knowledge

Spreadsheets