In case you have been studying my posts, you already know that I’ve an obsession with fairness threat premiums, which I consider lie on the heart of just about each substantive debate in markets and investing. As a part of that obsession, since September 2008, I’ve estimated an fairness threat premium for the S&P 500 in the beginning of every month, and never solely used that premium, when valuing firms throughout that month, however shared my estimate on my webpage and on social media. In my final submit, on nation threat premiums, I used the fairness threat premium of 5.00% that I estimated for the US in the beginning of July 2023, for the S&P 500. That mentioned, I do not blame you, if are confused not solely about how I estimate this premium, however what it measures. Actually, an article in MarketWatch earlier this 12 months referred to the fairness threat premium as an esoteric idea, a phrasing that steered that it had little relevance to the common investor. Including to the confusion are the proliferation of very completely different numbers that you could have seen connected to the present fairness threat premium, every normally quoting an knowledgeable within the area, however offering little context. Simply in the previous few weeks, I’ve seen a Wall Road Journal article put the fairness threat premium at 1.1%, a Reuters report put it at 2.2%, and a bearish (and extensively adopted) cash supervisor estimate the fairness threat premium to be adverse. How, it’s possible you’ll ask, can fairness threat premiums be that divergent, and does that indicate that something goes? On this submit, I cannot attempt to argue that my estimate is best than others, since that might be hubris, however as an alternative give attention to explaining why these ERP variations exist, and allow you to make your individual judgment on which one it’s best to use in your investing choices.

ERP: Definition and Determinants

The place to start out this dialogue is with an evidence of what an fairness threat premium is, the determinants of that quantity and why it issues for buyers. I’ll attempt to steer away from fashions and financial jargon on this part, just because they do little to advance understanding and far to muddy the waters.

What’s it?

Traders are threat averse, at the least within the mixture, and whereas that threat aversion can wax and wane, they want at the least the expectation of a better return to be induced to put money into riskier investments. Briefly, the anticipated return on a dangerous funding will be constructed because the sum of the returns you’ll be able to anticipate on a assured funding, i.e., a riskfree fee, and a threat premium, which is able to scale up as threat will increase.

Anticipated Return = Danger free Charge + Danger Premium

Word that this proposition holds even in case you consider that there’s nothing on the market that’s actually threat free, which is the case if you fear about governments defaulting, although it does indicate that you’ve cleansing as much as do to get to a riskfree fee. Word additionally that expectations don’t at all times pan out, and the precise returns on a dangerous funding will be a lot decrease than the danger free fee, and generally sharply adverse.

The chance premium that you just demand has completely different names in several markets. Within the company bond market, it’s a default unfold, an augmentation to the rate of interest that you just demand on a bond with extra default threat. In the actual property market, it’s embedded in a capitalization fee, an anticipated return utilized by actual property buyers to transform the revenue on an actual property property into a price for that property. Within the fairness market, it’s the fairness threat premium, the worth of threat for investing in equities as a category.

|

As you’ll be able to see, each asset class has a threat premium, and whereas these threat premiums are set by buyers inside every asset class, these premiums have a tendency to maneuver collectively a lot of the time.

Determinants

Because the fairness threat premium is a value for threat, set by demand and provide, it stands to purpose that it’s pushed not solely by financial fundamentals, but additionally by market temper. Equities characterize the residual declare on the companies in an financial system, and it ought to come as no shock that the basics that decide it span the spectrum:

Even a cursory examination of those fundamentals ought to lead you to conclude that not solely will fairness threat premiums differ throughout markets, offering an underpinning for the divergence in nation threat premiums in my final submit, however must also differ throughout time, for the reason that fundamentals themselves change over time.

Market costs are additionally pushed by temper and momentum, and never surprisingly, fairness threat premiums can change, as these moods shift. Particularly, fairness threat premiums can develop into too low (too excessive) if buyers are excessively upbeat (depressed) concerning the future, and thus develop into the final word receptacles for market hope and concern. Actually, one symptom of a market bubble is an fairness threat premium that turns into so low that it’s disconnected from fundamentals, establishing for an inevitable collision with actuality and a market correction.

Why it issues

If you’re a dealer, an investor or a market-timer, and you’re questioning why it’s best to care about this dialogue, it’s value recognizing that the fairness threat premium is a central part of what you do, even when you have by no means explicitly estimated or used it.

- Market Timing: Once you time markets, you make a judgment on how a whole asset class (equities, bonds, actual property) is priced, and reallocating your cash accordingly. Particularly, in case you consider that shares are overvalued, you’ll both have much less of your portfolio invested in equities or, in case you are aggressive, promote brief on equities. Any assertion about market pricing will be rephrased as an announcement about fairness threat premiums; in case you consider that the fairness threat premium, as priced in by the market, has develop into too low (relative to what you consider is justified, given historical past and fundamentals), you’re arguing that shares are overvalued (and due for a correction). Conversely, in case you consider that the fairness threat premium has develop into too excessive, relative once more to what you suppose is an affordable worth, you’re contending that shares are low-cost, within the mixture.

- Inventory Picker: Once you put money into a person inventory, you’re doing so since you consider that inventory is buying and selling at a value that’s decrease than your estimate of its worth. Nevertheless, to make this judgment, it’s a must to assess worth within the first place, and whereas we will debate development potential and profitability, the fairness threat premium turns into an enter into the method, figuring out what it’s best to earn as an anticipated return on a inventory. Put merely, in case you are utilizing an fairness threat premium in your organization valuation that’s a lot decrease (larger) than the market-set fairness threat premium, you’re biasing your self to seek out the corporate to be underneath (over) valued. A market-neutral valuation of an organization, i.e., a valuation of the corporate given the place the market is in the present day, requires you to at the least to attempt to estimate a premium that’s near what the market is pricing into equities.

- Company Finance: The function of the fairness threat premium in figuring out the anticipated return on a inventory makes it a key enter in company finance, as nicely, as a result of that anticipated return turns into the corporate’s price of fairness. That price of fairness is then embedded in a value of capital, and as fairness threat premiums rise, all firms will see their prices of capital rise. In a submit from the beginning of this 12 months, I famous how the surge in fairness threat premiums in 2022, mixed with rising treasury bond charges, induced the price of capital to extend dramatically in the course of the course of the 12 months.

Put merely, the fairness threat premiums that we estimate for markets have penalties for buyers and companies, and within the subsequent part, I’ll take a look at methods of estimating it.

Measurement

If the fairness threat premium is a market-set quantity for the worth of threat in fairness markets, how can we go about estimating it? Not like the bond market, the place rates of interest on bonds can be utilized to again out default spreads, fairness buyers will not be express about what they’re demanding as anticipated returns once they purchase shares. As a consequence, a spread of approaches have been used to estimate the fairness threat premium, and on this part, I’ll take a look at the pluses and minuses of every method.

1. Historic Danger Premium

Whereas we can not explicitly observe what buyers are demanding as fairness threat premiums, we will observe what they’ve earned traditionally, investing in shares as an alternative of one thing threat free (or shut). Within the US, that information is on the market for lengthy durations, with probably the most extensively used datasets going again to the Twenties, and that information has been sliced and diced to the purpose of diminishing returns. In the beginning of yearly, I replace the information to usher in the latest 12 months’s returns on shares, treasury bonds and treasury payments, and the beginning of 2023 included probably the most jarring updates in my reminiscence:

It was an uncommon 12 months, not simply because shares had been down considerably, but additionally as a result of the ten-year treasury bond, a a lot touted secure funding, misplaced 18% of its worth. Relative to treasury payments, shares delivered a adverse threat premium in 2022 (-20%), however it could be nonsensical to extrapolate from a single 12 months of knowledge. Actually, even in case you stretch the time durations out to 10, fifty or near hundred years, you’ll discover that your estimates of anticipated returns include important error (as will be seen in the usual errors).

In a lot of valuation, particularly within the appraisal neighborhood, historic threat premiums stay the prevalent normal for measuring fairness threat premiums, and there are just a few causes.

- Maybe, the truth that you’ll be able to compute averages exactly will get translated into the delusion that these averages are info, when, actually, they don’t seem to be simply estimates, however very noisy ones. For example, even in case you use your complete 94-year time interval (from 1928-2022), your estimate for the fairness threat premium for shares over ten-year treasury bonds is that it falls someplace between 2.34% to 10.94%, with 95% confidence (6.64% ± 2* 2.15%).

- It’s also true that the menu of selections that you’ve for historic fairness threat premiums, from a low of 4.12% to a excessive of 13.08%, relying on then time interval you take a look at, and what you employ as a riskfree fee, offers analysts an opportunity to let their biases play out. In any case, in case your job is to provide you with a low worth, all it’s a must to do is latch on to a excessive quantity on this desk, declare that it’s a historic threat premium and ship in your promise.

When utilizing historic fairness threat premiums, you’re assuming imply reversion, i.e., that returns revert to historic norms over time, although, as you’ll be able to see, these norms will be completely different, utilizing completely different time durations. You’re additionally assuming that the financial and market construction has not modified considerably over the estimation interval, i.e., that the basics that decide the danger premium have remained secure. For a lot of the 20th century, historic fairness threat premiums labored nicely as threat premium predictors in america, exactly as a result of these assumptions held up. With China’s rise, elevated globalization and the disaster of 2008 as precipitating elements, I’d argue that the case for utilizing historic threat premiums has develop into a lot weaker.

2. Historic Returns-Based mostly Forecasts

The second method to utilizing historic returns to estimate fairness threat premiums begins with the identical information as the primary method, however reasonably than simply use the averages to make the estimates, it seems to be for time collection patterns in historic returns that can be utilized to forecast anticipated returns. Put merely, this method brings into the estimate the correlation throughout time in returns:

If the correlations throughout time in inventory returns had been zero, this method would yield outcomes just like simply utilizing the averages (historic threat premiums), nevertheless it they don’t seem to be, it is going to result in completely different predictions. historic returns, the correlations begin off near zero for one-year returns however they do develop into barely extra adverse as you lengthen your time durations; the correlation in returns over 5-year time durations is -0.15, however it isn’t statistically important. Nevertheless, with 10-year time horizon, even that delicate correlation disappears. Briefly, whereas it could be potential to coax a predictive mannequin utilizing solely historic inventory returns, that mannequin is unlikely to yield a lot in actionable predictions. There are sub-periods the place the correlation is larger, however I stay skeptical of any ERP prediction mannequin constructed round simply the time collection of inventory returns.

In an extension of this method, you may herald a measure of the cheapness of shares (PE ratios or earnings yields are the most typical ones) into the historic return information and exploit the connection (if any) between the 2. If there’s a relationship, optimistic or adverse, between PE ratios and subsequent returns, a regression of returns towards PE (or EP) ratios can be utilized to generate predictions of anticipated annual returns within the subsequent 12 months, subsequent 5 years or the subsequent decade. The determine under is the scatter plot of earnings to cost ratios towards inventory returns within the subsequent ten years, utilizing information from 1960 to 2022:

A regression utilizing this information yields a number of the lowest estimates of the ERP, particularly for longer time horizons, due to the elevated ranges of PE ratios in the present day. Actually, on the present EP ratio of about 4%, and utilizing the historic statistical hyperlink with long-term returns, the estimated anticipated annual return on shares, over the subsequent 10 years and primarily based on this regression is:

- Anticipated Return on Shares, conditional on EP = .00254 + 1.4543 (.04) = .0607 or 6.07%

- ERP primarily based on EP-based Anticipated Return = 6.07% – 3.97% = 2.10%

It’s value remembering that the anticipated return predictions include error, and the extra applicable use of this regression is to get a spread for the anticipated annual return, which yields predictions starting from 4% to eight%. Extending the regression again to 1928 will increase the R-squared and ends in some regressions that yield predicted inventory returns which can be decrease than the treasury-bond fee, i.e., a adverse fairness threat premium, given the EP ratio in the present day.

Word that the outcomes from this regression simply reinforce guidelines of thumb for market timing, primarily based upon PE ratios, the place buyers are directed to promote (purchase) shares if PE ratios transfer above (under) a “truthful worth” band. Since these guidelines of thumb have yielded questionable outcomes, it pays to be skeptical about these regressions as nicely, and there are three limitations that those that use it have to bear in mind.

- First, with the longer time-period predictions, the place the predictive energy is strongest, the identical information is counted a number of instances within the regression. Thus, with 5-year returns, you match the EP ratio on the finish of 1960 with returns from 1961 to 1965, after which the EP ratio on the finish of 1961 with returns from 1962 to 1966, and so forth. Whereas this doesn’t indicate that you just can not run these regression, it does point out that the statistical significance (R squared and t statistics) are overstated for the longer time horizons. As well as, the longer your time horizon, the extra information you lose. With a 10-year time horizon, as an example, the final 12 months that you need to use for predictions is 2012, with the EP ratio in that 12 months matched as much as the returns from 2013-2022.

- Second, as is the case with the primary method (historic threat premiums), you’re assuming that the structural mannequin is secure and that there will likely be imply reversion. Actually, inside this time interval (1928 – 2022), the predictive energy is much larger between 1928 and 1960 than it’s betweeen 196 and 2022.

- Third, whereas these fashions tout excessive R-squared, the quantity that issues is the usual error of the predictions. Predicting that your annual return will likely be 6.07% for the subsequent decade with a normal error of two% yields a spread that leaves you, as an investor, in suspended animation, because you face daunting questions on comply with by: Does a low anticipated return on shares over the subsequent decade imply that it’s best to pull your whole cash out of equities? If sure, the place do you have to make investments that money? And when would you get again into equities once more?

Proponents of this method are among the many most bearish buyers out there in the present day, however it’s value noting that this method would have yielded “low return” predictions and stored you out of shares for a lot of the final decade.

3. The Fed Mannequin: Earnings Yield and ERP

The issue with historic returns approaches is that they’re backward-looking, when fairness threat premiums must be about what buyers anticipate to earn sooner or later. To the extent that worth is pushed by anticipated future money flows, you’ll be able to again out an fairness threat premium from present inventory costs, in case you are prepared to make assumptions about earnings development and money flows sooner or later. Within the easiest model of this method, you begin with a stable-growth dividend low cost mannequin, the place the worth of fairness will be written as the current worth of dividends, rising at a relentless fee without end:

For those who assume that earnings will stagnate at present ranges, i.e., no earnings development, and that firms pay out their complete earnings as dividends (payout ratio = 100%), the price of fairness will be approximated by the earnings to cost ratio:

Alternatively, you’ll be able to assume that there’s earnings development and that firms earn returns on fairness equal to their prices of fairness, you arrive on the similar outcome:

Briefly, the earnings to cost ratio turns into a tough proxy for what you’ll be able to anticipate to earn as a return on shares, in case you are prepared to imagine no earnings development or that corporations generate no extra returns.

That is the idea for the extensively used Fed mannequin, the place the earnings yield is in comparison with the treasury bond fee, and the fairness threat premium is the distinction between the 2. Within the determine under, you’ll be able to see the fairness threat premiums over time that emerge from this comparability, on a quarterly foundation, from 1988 to 2023:

As you’ll be able to see, this method yields some “unusual” numbers, with adverse fairness threat premiums for a lot of the Nineties, the most effective a long time for investing in shares during the last century. It’s true that the fairness threat premiums have been way more optimistic on this century, however that’s largely as a result of the treasury bond fee dropped to historic lows, after 2008. As rates of interest have risen during the last 12 months and a half, with inventory costs surging over the identical interval, the fairness threat premium primarily based on this method has dropped, standing at 0.41% in the beginning of August 2023. Since that is the method used within the Wall Road Journal article, it explains the ERP being at a two-decade low, however I do discover it odd that there isn’t any point out that this method yielded adverse premiums within the Nineteen Eighties and Nineties. In a variant, the Wall Road Journal article additionally seems to be on the distinction between the earnings yield and the inflation-protected treasury fee, which yields the next worth for the ERP, of about 3%, however suffers from lots of the similar points as the usual method.

My drawback with the earnings yield method to estimating fairness threat premiums is that the assumptions that it is advisable to make to justify its use are are at battle with the information. First, whereas earnings development for US shares has been adverse in some years, it has been optimistic each decade for the final century, and there aren’t any analysts (that I’m conscious of) anticipating it’s zero (in nominal phrases) sooner or later. Second, assuming that the return on fairness is the same as the price of fairness could also be straightforward on paper, however the precise return on fairness for firms within the S&P 500 was 19.73% in 2022, 17.04% during the last decade and has been larger than the price of fairness even within the worst 12 months on this century (9.35% in 2008). For those who permit for development in earnings and extra returns, it’s clear that earnings yield will yield too low a price for the ERP, due to these omissions, and can yield adverse values in lots of durations, making it ineffective as an ERP estimator for valuation.

4. Implied ERP

I begin with the identical normal mannequin for worth that the earnings yield method does, which is the dividend low cost mannequin however change three parts

- Augmented Dividends: It’s simple that firms all over the world, however particularly within the US, have shifted from returning money within the type of dividends to inventory buybacks. Since two-thirds of the money returned in 2022 was within the type of buybacks, ignoring them will result in understating anticipated returns and fairness threat premiums. Consequently, I add buybacks to dividends to reach at an augmented measure of money returned and use that as the bottom for my forecasts.

- Permit for near-term development in Earnings: Because the goal is to estimate what buyers are demanding as an anticipated return, given their expectations of development, I take advantage of analyst estimates of development in earnings for the index. To get these development charges, I give attention to analysts who estimate aggregated earnings development the index, reasonably than aggregating the expansion charges estimated by analysts for particular person firms, the place you threat double counting buybacks (since analyst estimates are sometimes in earnings per share) and bias (since firm analysts are inclined to over estimated development).

- Extra Returns and Cashflows: I begin my forecasts by assuming that firms will return the identical proportion of earnings in money flows, was they did in the latest 12 months, however I permit for the choice of adjusting that money return proportion over time, as a perform of development and return on fairness (Sustainable money payout = Development fee/ Return on Fairness).

The ensuing mannequin in its generic type is under:

In August 2023, this mannequin would have yielded an fairness threat premium of 4.44% for the S&P 500, utilizing trailing money flows from the final twelve months as a place to begin, estimating mixture earnings for the businesses from analyst estimates, for the subsequent three years, after which scaling that development right down to the danger free fee, as a proxy for nominal development within the financial system, after 12 months 5:

To reconcile my estimate of the fairness threat premium with the earnings yield method, you’ll be able to set the earnings development fee to zero and the money payout to 100%, on this mannequin, and you’ll find that the fairness threat premium you get converges on the 0.41% that you just get with the earnings yield method. Including development and extra returns to the equation is what brings it as much as 4.44%, and I consider that the information is on my aspect, on this debate. To the critique that my method requires estimates of earnings development and extra returns that could be improper, I agree, however I’m prepared to wager that no matter errors I make on both enter will likely be smaller than the enter errors made by assuming no development and no extra returns, as is the case with the earnings yield method.

Choosing an Method

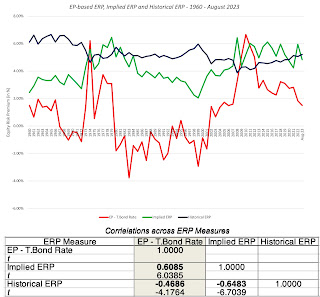

I choose the implied fairness threat premium method that I simply described, as one of the best estimate of ERP, however that will simply replicate my consolation with it, developed over time. In the end, the check of which method is one of the best one for estimating fairness threat premium shouldn’t be theoretical, however pragmatic, since your estimate of the fairness threat premium is used to acquire predictions of returns in subsequent durations. Within the determine under, I spotlight three estimates of fairness threat premiums – the historic threat premium by the beginning of that 12 months and the EP-based ERP (EP Ratio minus the T.Bond Charge) and the implied fairness threat premiums, in the beginning of the 12 months:

|

The historic threat premium is secure, however that stability is a mirrored image of a having a protracted tail of historic information that retains it from altering, even after the worst of years. The implied and EP-based ERP approaches transfer in the identical route a lot of the time (as evidenced within the optimistic correlation between the 2 estimates), however the latter yields adverse values for the fairness threat premium in numerous durations.

In the end, the check of whether or not an fairness threat premium measure works lies in how nicely it predicts future returns on shares, and within the desk under, I attempt to seize that in a correlation matrix, the place I take a look at the correlation of every ERP measure with returns within the subsequent 12 months, within the subsequent 5 years and within the subsequent 10 years:

Not one of the approaches yield correlations which can be statistically important, for inventory returns within the subsequent 12 months, however the implied ERP and historic ERP are strongly correlated with returns over longer time durations, with a key distinction; the previous strikes with inventory returns within the subsequent ten years, whereas the latter strikes inversely.

Whereas that correlation lies on the coronary heart of why I take advantage of implied ERP in my valuations as my estimate of the worth of threat in fairness markets, I’m averse to utilizing it as a foundation for market timing, for a similar causes that I cautioned you on utilizing the EP ratio regression: the predictions are noisy and there’s no clear pathway to changing them into funding actions. To see why, I’ve summarized the outcomes of a regression of inventory returns over the subsequent decade towards the implied ERP in the beginning of the interval, utilizing information from 1960 to 2022:

Conclusion

I hope that this submit has helped to persuade you that the fairness threat premium is central to investing, and that even when you have by no means used the time period, your investing actions have been pushed by its gyrations. I additionally hope that it has given you perspective on why you see the variations in fairness threat premium numbers from completely different sources. With that mentioned, listed here are some ideas for the street that may enable you to in future encounters with the ERP:

- There’s a true, albeit unobservable, ERP: The truth that the the true fairness threat premium is unobservable doesn’t imply that it doesn’t exist. In different phrases, the notion that you would be able to get away utilizing any fairness threat premium you need, so long as you might have a justification and are constant, is absurd. So, no matter qualms you could have concerning the estimation approaches that I’ve described on this submit, please hold working by yourself variant to get a greater estimate of the ERP, since giving up is not any an possibility.

- Not all estimation approaches are created equal: Whereas there are various approaches to estimating the fairness threat premium, and so they yield very completely different numbers, a few of these approaches have extra heft, as a result of they provide higher predictive energy. Choosing an method, such because the historic threat premium, as a result of its stability over time offers you a way of management, or as a result of everybody else makes use of it, makes little sense to me.

- Your finish recreation issues: As I famous in the beginning of this submit, the fairness threat premium can be utilized in a large number of funding settings, and it’s a must to resolve, for your self, how you’ll use the ERP, after which decide an method that works for you. I’m not a market timer and estimate an fairness threat premium primarily as a result of I want it as an enter in valuation and company finance. That requires an method that yields optimistic values (ruling out the EP-based ERP) and strikes with with inventory returns in subsequent durations (eliminating historic ERP).

- Market timers face a extra acid check: If you’re utilizing fairness threat premiums and even earnings yield for market timing, acknowledge that having a excessive R-squared or correlation in previous returns won’t simply translate into market-timing earnings, for 2 causes. First, the previous shouldn’t be at all times prologue, and market and financial constructions can shift, undercutting a key foundation for utilizing historic information to make predictions. Second, even when the correlations and regressions maintain, you should still discover it arduous to revenue from them, because you (and your shoppers, in case you are a portfolio supervisor) could also be bankrupt, earlier than your predictions play out. Statistical noise (the usual errors in your regression predictions) can create havoc in your portfolios, even when it will definitely will get averaged out.

YouTube Video

Knowledge Hyperlinks

- Historic returns on Shares, Bonds and Actual Property: 1928 – 2022

- Earnings to Worth Ratios and Dividend Yields, by Quarter: 1988 This fall- 2023 Q2

- Implied ERP from 1960 to 2022: Annual Knowledge

- ERP and Inventory Returns: 1960 to 2022

Spreadsheet

Papers