Introduction

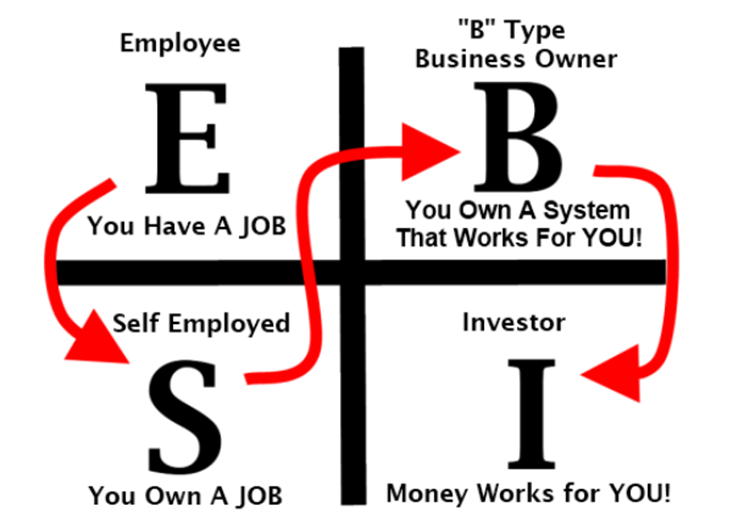

The idea of the Cashflow Quadrant was popularized by Robert Kiyosaki in his guide “Wealthy Dad’s Cashflow Quadrant.” It’s a highly effective idea that categorizes the alternative ways folks generate earnings. The Cashflow Quadrant is split into 4 classes: Worker (E), Self-Employed (S), Enterprise Proprietor (B), and Investor (I). Understanding these quadrants might help people navigate their monetary journey and obtain monetary independence.

The 4 Quadrants

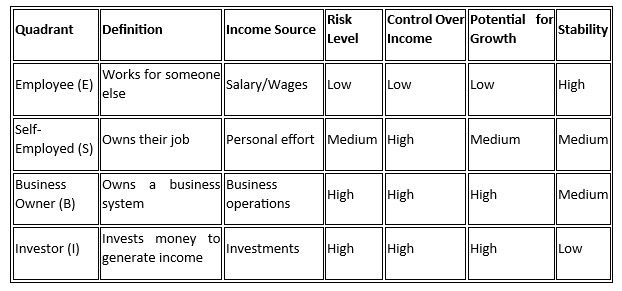

Worker (E)

Workers work for others and earn a paycheck. They alternate effort and time for cash, usually receiving a gentle, predictable earnings. Workers typically take pleasure in advantages resembling medical health insurance, retirement plans, and job safety. Nonetheless, they’re typically restricted by their wage and have much less management over their monetary future.

Earnings Supply: Wage or wages

Time Dedication: Mounted hours

Self-Employed (S)

Self-employed people work for themselves. They might personal a small enterprise, work as freelancers, consultants, or professionals resembling medical doctors and attorneys. Whereas they’ve extra management over their work, their earnings is instantly tied to their time and effort, typically resulting in lengthy hours and restricted scalability.

Earnings Supply: Charges, commissions, or enterprise earnings

Time Dedication: Variable, typically in depth

Enterprise Proprietor (B)

Enterprise house owners construct programs and rent folks to work for them. They leverage different folks’s time and abilities to generate earnings, permitting for larger scalability and potential passive earnings. Enterprise house owners concentrate on constructing and managing programs quite than working inside them.

Earnings Supply: Enterprise earnings, dividends

Time Dedication: Preliminary excessive dedication, doubtlessly lowering over time

Investor (I)

Buyers generate earnings by placing their cash to work. They spend money on property resembling shares, bonds, actual property, and companies. Their earnings is derived from the returns on their investments, offering the potential for substantial passive earnings and monetary freedom.

Earnings Supply: Funding returns (dividends, curiosity, capital positive aspects)

Time Dedication: Low to reasonable (analysis and administration)

The Quadrants and their Traits

Transitioning Between Quadrants

Robert Kiyosaki emphasizes specializing in the fitting facet of the Cashflow Quadrant—Enterprise Proprietor and Investor—to attain vital wealth. That mentioned, you don’t want to completely transition to a different quadrant abruptly. You possibly can preserve involvement in a number of quadrants concurrently. For instance, one might begin as an Worker + Investor. Beginning as an Worker + Investor permits people to construct a steady earnings whereas investing for progress. As investments develop, transitioning to a Enterprise Proprietor function can additional improve monetary stability and wealth. Combining Enterprise Proprietor and Investor roles maximizes wealth potential by diversified earnings streams and reinvestment of earnings.

By specializing in the fitting facet and strategically combining quadrants, people can construct a stable basis for long-term monetary success and wealth accumulation.

Transitioning from one quadrant to a different requires a shift in mindset and technique. Listed below are some suggestions for making these transitions:

From Worker to Self-Employed

· Develop Abilities: Purchase abilities related to your required self-employed area.

· Construct a Community: Set up a community of potential purchasers and mentors.

· Create a Enterprise Plan: Define what you are promoting targets, methods, and monetary projections.

From Self-Employed to Enterprise Proprietor

· Systematize Your Enterprise: Develop programs and processes to streamline operations.

· Rent Employees: Recruit staff or contractors to take over day-to-day duties.

· Deal with Development: Shift your focus from working within the enterprise to rising it.

From Enterprise Proprietor to Investor

· Educate Your self: Study totally different funding choices and techniques.

· Diversify: Unfold your investments throughout numerous asset courses to mitigate danger.

· Leverage Experience: Work with monetary advisors and funding professionals.

To Sum Up

The Cashflow Quadrant offers a priceless framework for understanding totally different earnings technology strategies. By recognizing the place you at present stand and the place you aspire to be, you can also make strategic choices to attain monetary freedom. Whether or not you’re an worker trying to transition to self-employment or a enterprise proprietor aiming to turn into an investor, the bottom line is steady studying and strategic planning.