Up to date on January 26, 2025 with up to date screenshots from TurboTax Deluxe downloaded software program for the 2024 tax yr. For those who use different tax software program, see:

For those who did a Backdoor Roth, which includes making a non-deductible contribution to a Conventional IRA after which changing from the Conventional IRA to a Roth IRA, you should report each the contribution and the conversion within the tax software program. For extra info on Backdoor Roth usually, see Backdoor Roth: A Full How-To.

What To Report

You report on the tax return your contribution to a Conventional IRA *for* that yr, and also you additionally report your conversion to Roth *throughout* that yr.

For instance, if you find yourself doing all of your tax return for 2024, you report the contribution you made *for* 2024, whether or not you really did it throughout 2024 or between January 1 and April 15, 2025. You additionally report your conversion to Roth *throughout* 2024, whether or not the contribution was made for 2024, 2023, or any earlier years.

Subsequently a contribution made throughout 2025 for yr 2024 goes on the tax return for yr 2024. A conversion executed throughout 2025 after you contributed for 2024 goes on the tax return for 2025.

You do your self a giant favor and keep away from quite a lot of confusion by doing all of your contribution for the present yr and ending your conversion in the identical yr. I name this a “deliberate” Backdoor Roth or a “clear” Backdoor Roth — you’re doing it intentionally. Don’t wait till the next yr to contribute for the earlier yr. Contribute for 2024 in 2024 and convert it throughout 2024. Contribute for 2025 in 2025 and convert it throughout 2025. This manner every part is clear and neat.

If you’re already off by one yr, it is determined by whether or not you’re dealing with the contribution half or the conversion half proper now. For those who contributed to a Conventional IRA for 2024 in 2025 and transformed in 2025 or in the event you recharacterized a 2024 Roth contribution in 2025 and transformed in 2025, please comply with Break up-12 months Backdoor Roth IRA in TurboTax, 1st 12 months. For those who contributed to a Conventional IRA for 2023 in 2024 and transformed in 2024 or in the event you recharacterized a 2023 Roth contribution in 2024 and transformed in 2024, please comply with Break up-12 months Backdoor Roth IRA in TurboTax, 2nd 12 months. For those who recharacterized your 2024 Roth contribution in 2024 and transformed in 2024, please comply with Backdoor Roth in TurboTax: Recharacterize & Convert, Similar 12 months.

Use TurboTax Obtain

The screenshots under are from TurboTax Deluxe downloaded software program. The downloaded software program is means higher than on-line software program. For those who haven’t paid on your TurboTax On-line submitting but, you should purchase TurboTax obtain from Amazon, Costco, Walmart, and plenty of different locations and change from TurboTax On-line to TurboTax obtain (see directions for the best way to make the change from TurboTax).

Right here’s the deliberate “clear” Backdoor Roth state of affairs we are going to use for example:

You contributed $7,000 to a conventional IRA in 2024 for 2024. Your revenue is just too excessive to say a deduction for the contribution. By the point you transformed it to Roth IRA, additionally in 2024, the worth grew to $7,200. You haven’t any different conventional, SEP, or SIMPLE IRA after you transformed your conventional IRA to Roth. You didn’t roll over any pre-tax cash from a retirement plan to a conventional IRA after you accomplished the conversion.

In case your state of affairs is completely different, you’ll have to make some changes to the screens proven right here.

Earlier than we begin, suppose that is what TurboTax exhibits:

We are going to evaluate the outcomes after we enter the Backdoor Roth.

Convert Conventional IRA to Roth

The tax software program works on revenue gadgets first. Despite the fact that the conversion occurred after the contribution, we enter the conversion first.

Once you convert from a Conventional IRA to a Roth IRA, you’ll obtain a 1099-R kind. Full this part provided that you transformed *throughout* 2024. For those who solely transformed throughout 2025, you received’t have a 1099-R till subsequent January. Please comply with Break up-12 months Backdoor Roth IRA in TurboTax, 1st 12 months. In case your conversion throughout 2024 was in opposition to a contribution you made for 2023 or a 2023 contribution you recharacterized in 2024, please comply with Break up-12 months Backdoor Roth IRA in TurboTax, 2nd 12 months.

In our instance, we assume by the point you transformed, the cash within the Conventional IRA had grown from $7,000 to $7,200.

Enter 1099-R

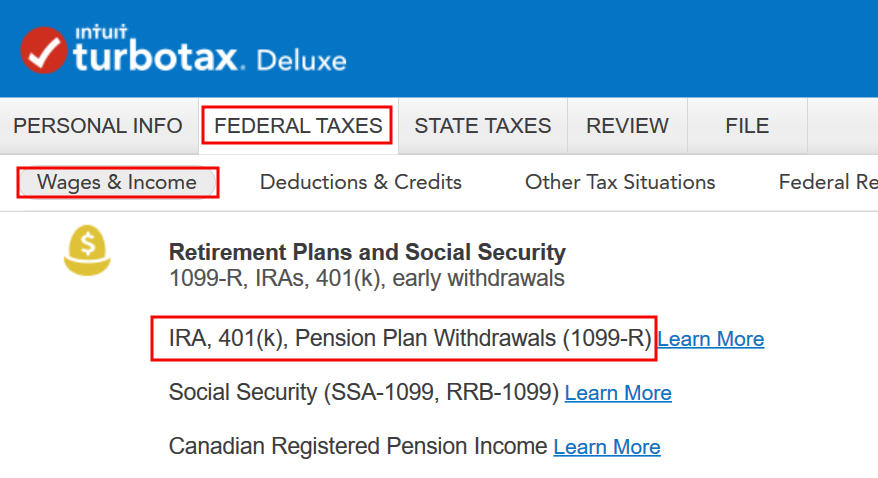

Go to Federal Taxes -> Wages & Revenue -> IRA, 401(okay), Pension Plan Withdrawals (1099-R).

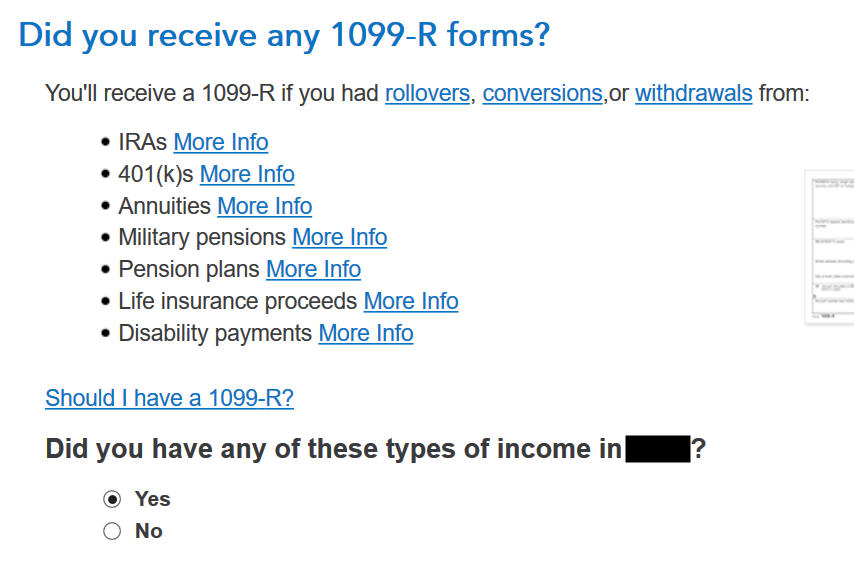

As you’re employed by way of the interview, you’ll finally come to the purpose of coming into the 1099-R. Choose Sure, you have got this sort of revenue. Import the 1099-R in the event you’d like. I’m selecting to kind it myself.

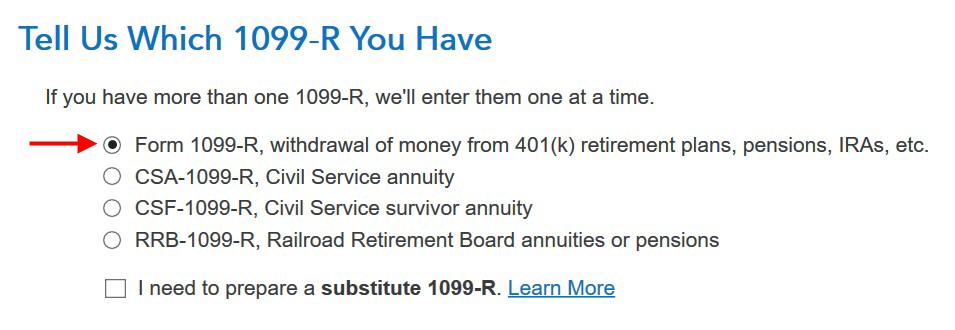

Simply the common 1099-R.

Field 1 exhibits the quantity transformed to the Roth IRA. It’s regular to have the identical quantity because the taxable quantity in Field 2a when Field 2b is checked saying “taxable quantity not decided.” Take note of the code in Field 7 and the IRA/SEP/SIMPLE field. Make sure that your entry matches your 1099-R precisely.

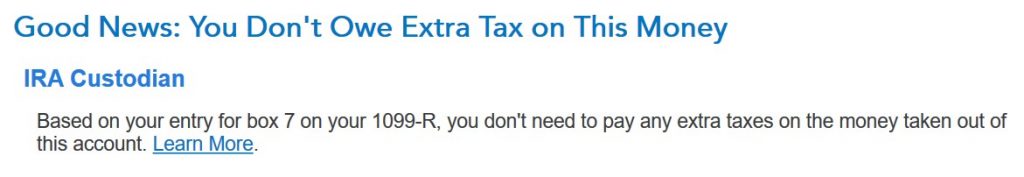

You get this Good Information, however …

Your refund in progress drops rather a lot. We went from $2,384 all the way down to $858. Don’t panic. It’s regular and short-term.

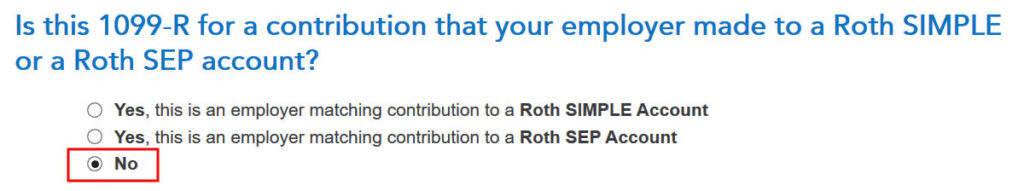

It has nothing to do with an employer.

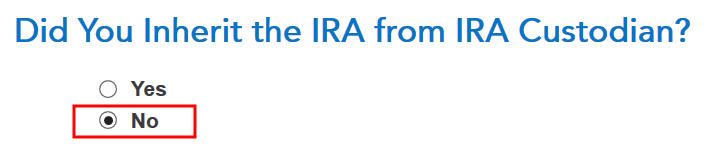

Didn’t inherit it.

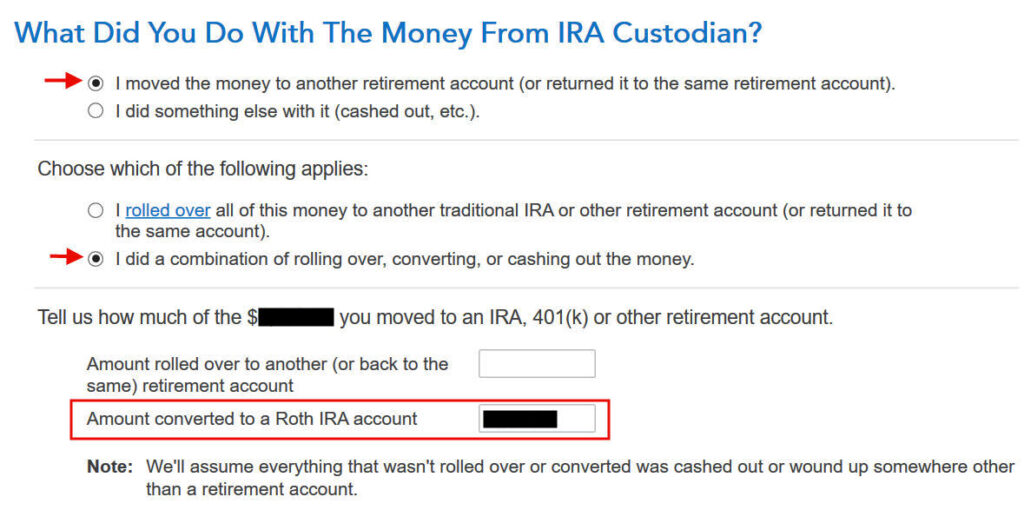

Transformed to Roth

First click on on “I moved …” then click on on “I did a mix …” Enter the quantity you transformed within the field. It’s $7,200 in our instance. Don’t select the “I rolled over …” choice. A Roth conversion shouldn’t be a rollover.

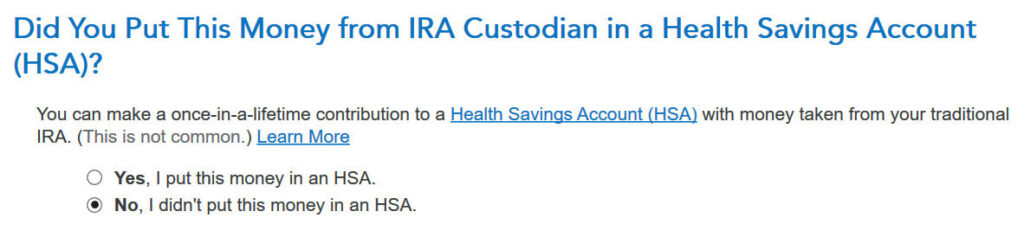

No, you didn’t put the cash in an HSA.

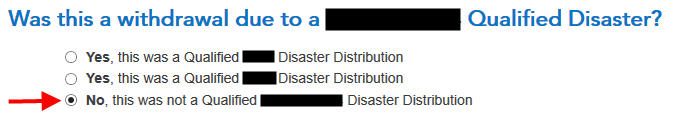

It wasn’t on account of a catastrophe.

You get a abstract of your 1099-R’s. Repeat the earlier steps so as to add one other if in case you have multiple. For those who’re married and each of you probably did a Backdoor Roth, enter the 1099-R for each of you, however take note of choose whose 1099-R it’s. Don’t by chance assign two 1099-R types to the identical individual.

Foundation

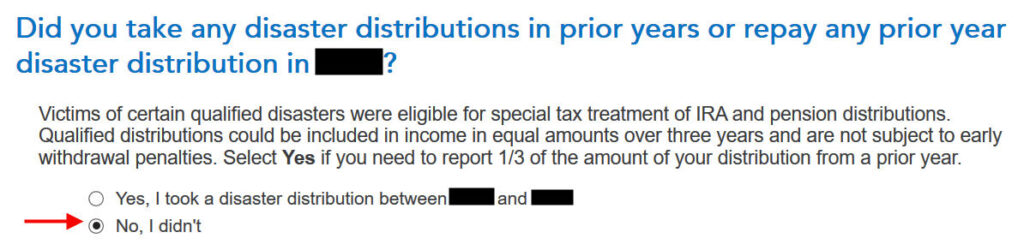

Didn’t take or repay any catastrophe distribution.

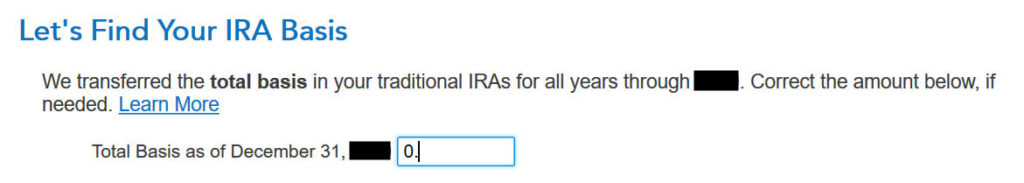

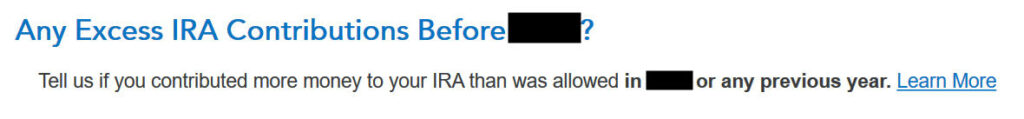

Right here it’s asking in regards to the carryover from the prior yr. Once you did a clear “deliberate” Backdoor Roth as in our instance — contributed for 2024 in 2024 and transformed earlier than the top of 2024 — you possibly can reply No right here however answering Sure with a 0 has the identical impact as answering No and it permits you to right errors.

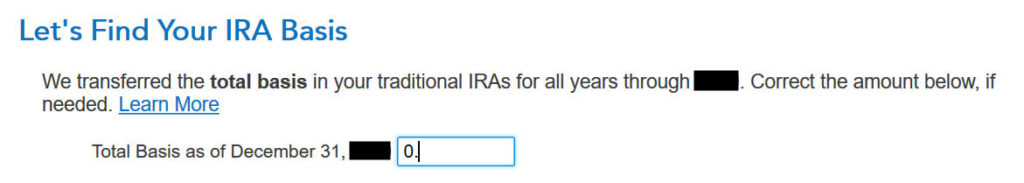

For those who answered Sure to the earlier query and you probably did your earlier yr’s return accurately additionally in TurboTax, your foundation from the earlier yr will present up right here. For those who did your earlier yr’s tax return mistaken, repair your earlier return first.

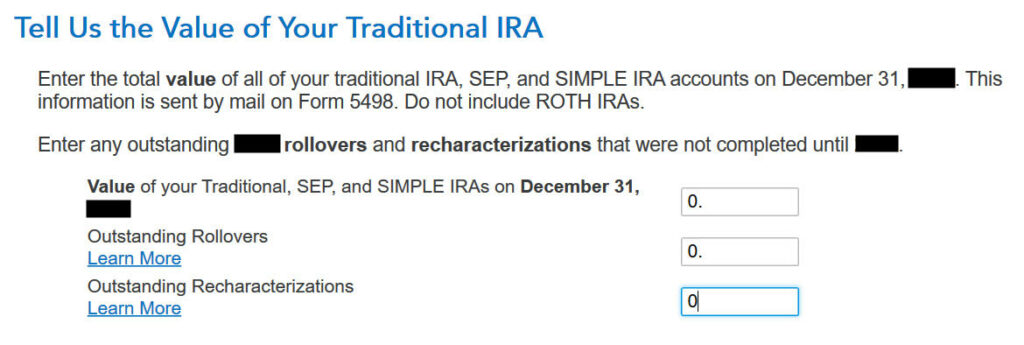

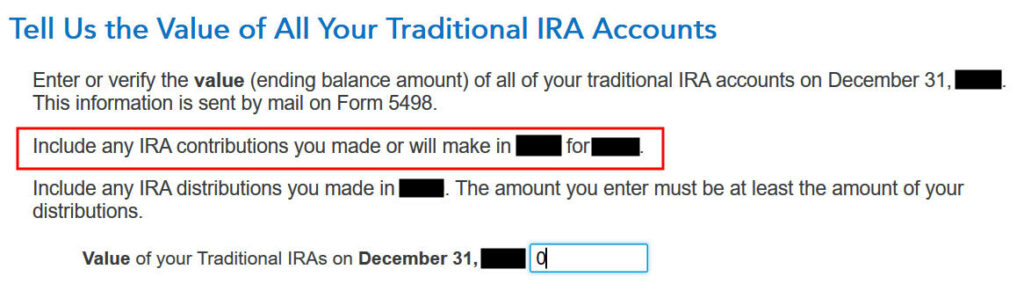

Enter the values of ALL your Conventional, SEP, and SIMPLE IRAs on the finish of the yr. We don’t have something in conventional, SEP, or SIMPLE IRAs after we transformed all of it. In case your account posted earnings after you transformed and also you left the earnings within the account, get the worth out of your year-end assertion and put it within the first field.

That’s it to date on the revenue facet. Proceed with different revenue gadgets. The refund in progress remains to be quickly depressed. Don’t fear. It’s going to change.

Non-Deductible Contribution to Conventional IRA

Now we enter the non-deductible contribution to a Conventional IRA *for* 2024.

For those who contributed for 2024 between January 1 and April 15, 2025 or in the event you recharacterized a 2024 contribution in 2025, please comply with Backdoor Roth in TurboTax: Recharacterize and Convert, 1st 12 months. In case your contribution throughout 2024 was for 2023, be sure you entered it on the 2023 tax return. If not, repair your 2023 return first by following the steps in Backdoor Roth in TurboTax: Recharacterize and Convert, 1st 12 months.

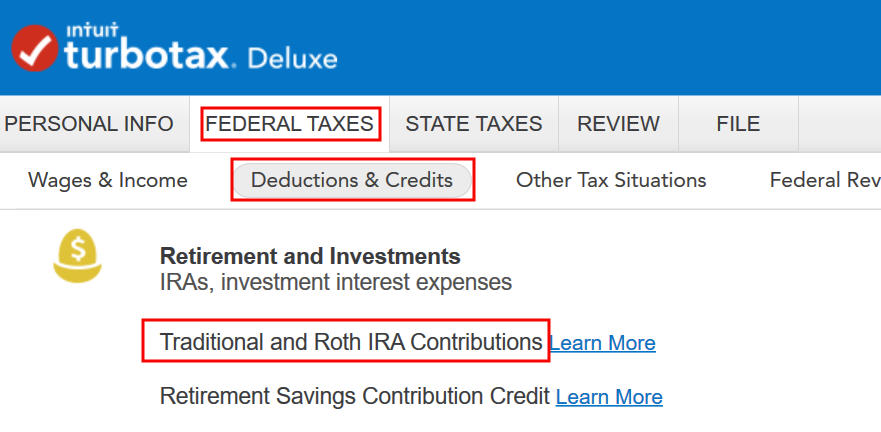

Go to Federal Taxes -> Deductions & Credit -> Conventional and Roth IRA Contributions.

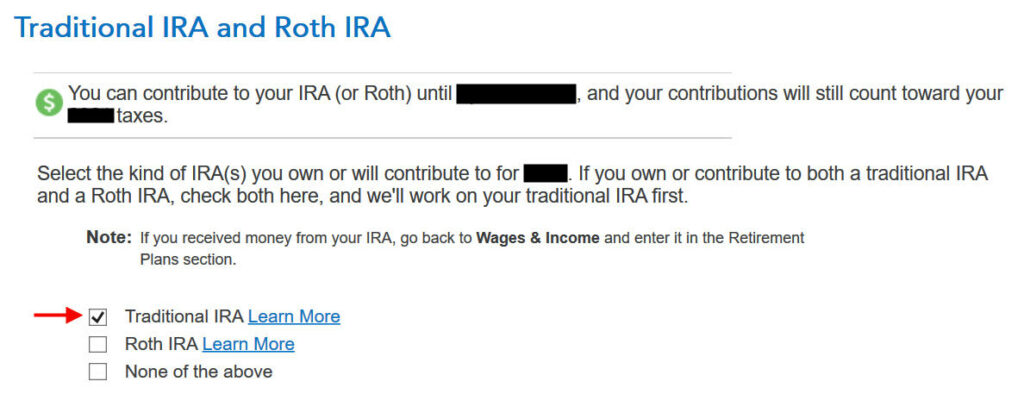

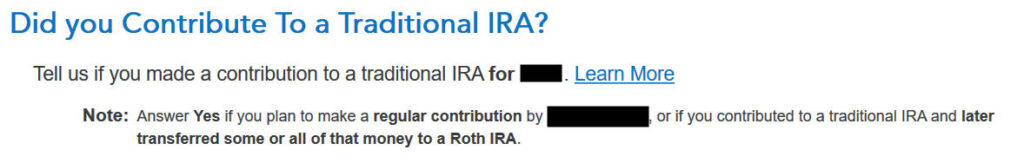

As a result of we did a clear “deliberate” Backdoor Roth, we examine the field for Conventional IRA.

TurboTax provides an improve however we don’t want it. Select to proceed in TurboTax Deluxe.

We already checked the field for Conventional however TurboTax simply desires to verify. Reply Sure right here.

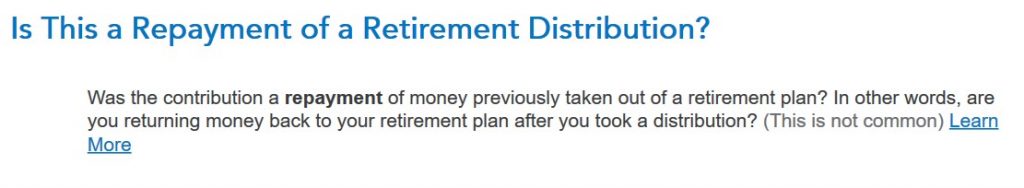

It was not a compensation of a retirement distribution.

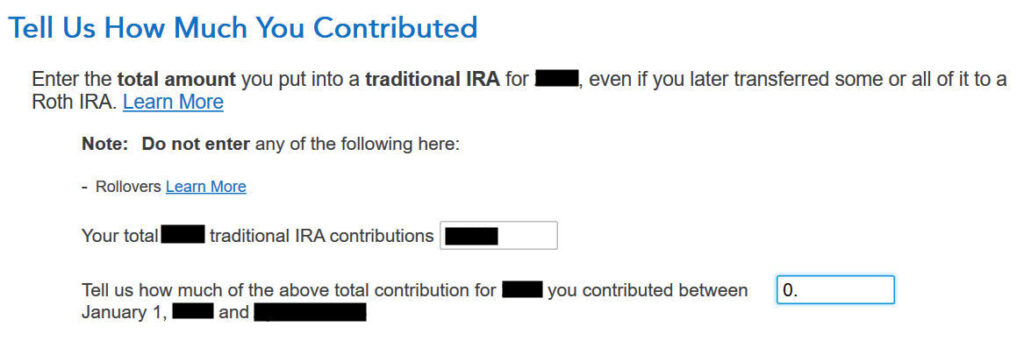

Enter the contribution quantity. It’s $7,000 in our instance. As a result of we contributed for yr 2024 in 2024, we put zero within the second field. For those who contributed for 2024 between January 1 and April 15, 2025, enter the contribution in each bins.

Instantly our federal refund in progress goes again up! We began with $2,384. It went all the way down to $858. Now it comes again to $2,335. The $49 distinction is as a result of we now have to pay tax on the $200 in earnings once we contributed $7,000 and transformed $7,200. For those who had much less earnings, your refund numbers can be nearer nonetheless.

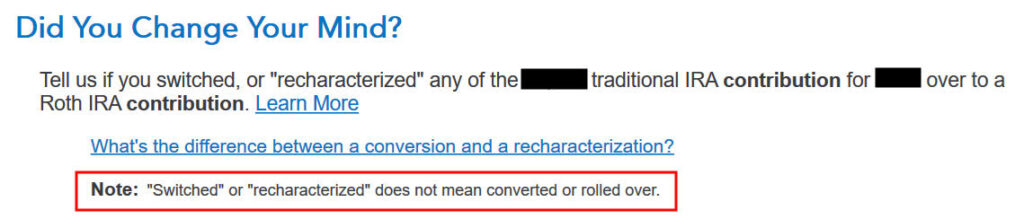

Transformed, Did Not Recharacterize

This can be a essential query. Reply “No.” You transformed the cash, not switched or recharacterized.

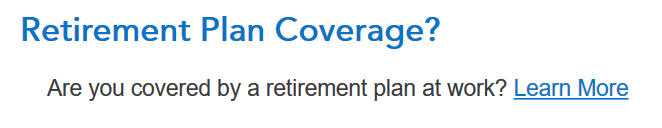

Chances are you’ll not get this query in the event you already entered your W-2 and it has Field 13 for the retirement protection checked. Reply sure in the event you’re coated by a retirement plan however the field in your W-2 wasn’t checked.

No extra contribution.

Foundation

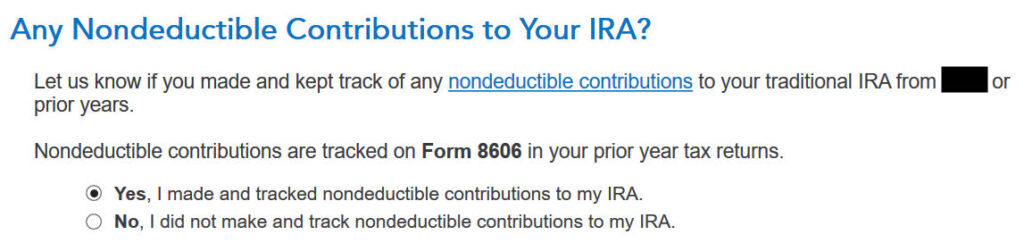

TurboTax asks the identical query we noticed earlier than. For a clear “deliberate” Backdoor Roth, we are able to reply No however answering Sure with a 0 has the identical impact and it permits you to right errors.

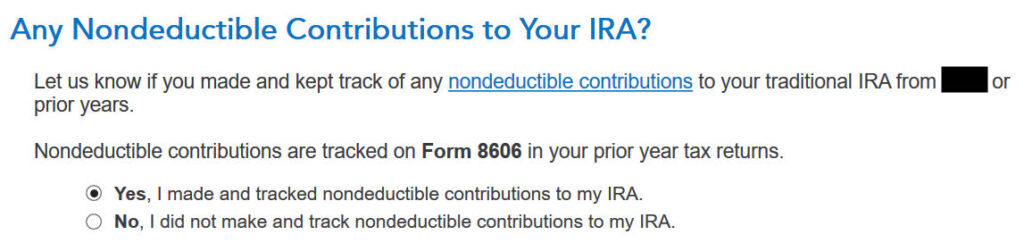

For those who did your taxes accurately on TurboTax final yr, TurboTax transfers the quantity right here. For those who made non-deductible contributions for earlier years (no matter when), enter the quantity on line 14 of your Kind 8606 from final yr.

Make It Nondeductible

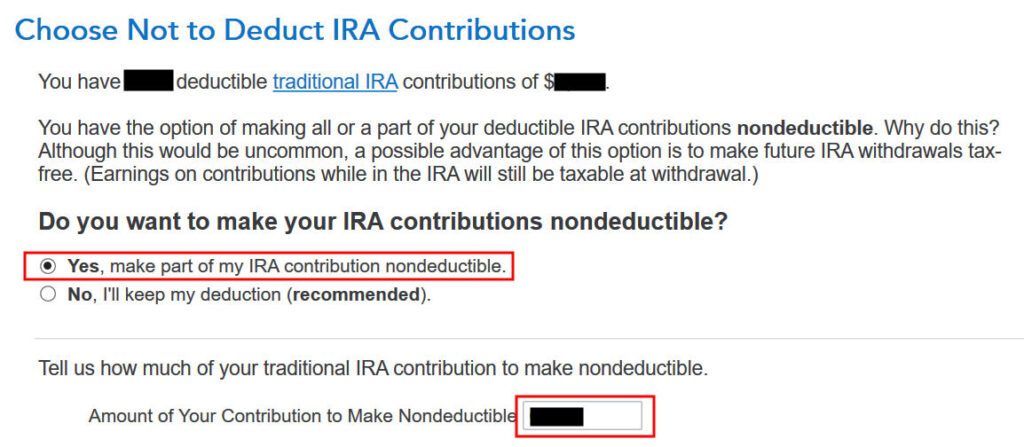

TurboTax exhibits this display if it sees that you simply qualify for a deduction for the Conventional IRA contribution. For those who take the deduction it’ll make your Roth conversion taxable, which creates a wash. It’s less complicated in the event you make your full IRA contribution nondeductible, after which your Roth conversion received’t be taxable. Enter the quantity that TurboTax says is deductible.

As a result of we did a clear “deliberate” Backdoor Roth, we don’t have something left after we transformed every part earlier than the top of the identical yr. In case you have a small steadiness left due to curiosity, enter the worth out of your year-end assertion right here.

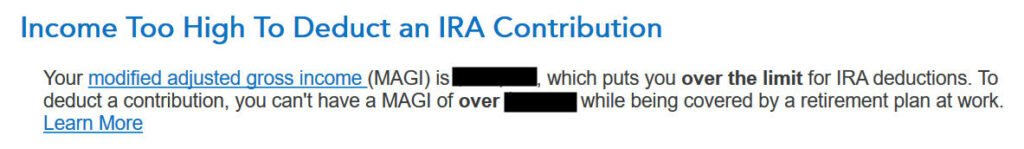

We all know our revenue was too excessive. That’s why we did the Backdoor Roth.

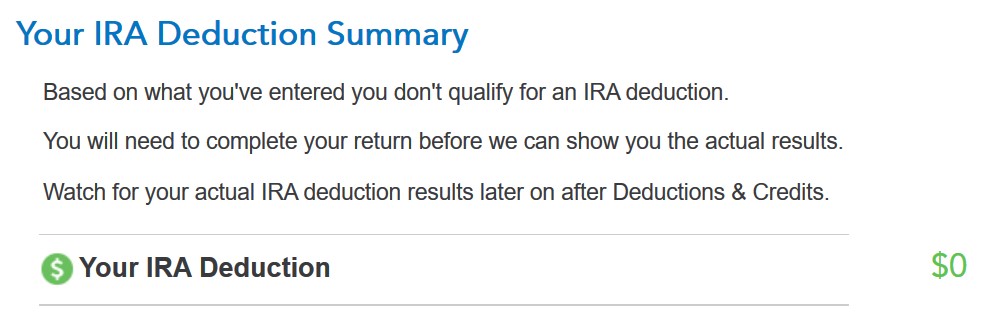

The IRA deduction abstract exhibits a $0 deduction, which is anticipated.

Taxable Revenue from Backdoor Roth

After going by way of all these, would you wish to see how you might be taxed on the Backdoor Roth?

Click on on Types on the highest proper.

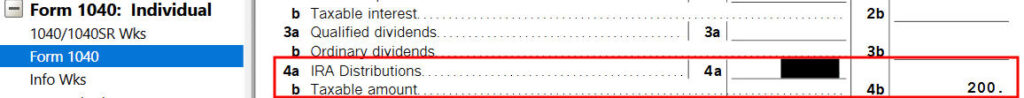

Discover Kind 1040 within the left navigation panel. Scroll up or down on the proper to search out strains 4a and 4b. They present a $7,200 distribution from the IRA and solely $200 of the $7,200 is taxable in our instance. That’s the earnings between the time you contributed to your Conventional IRA and the time you transformed it to Roth.

Once you’re executed inspecting the shape, click on on Step-by-Step on the highest proper to return to the interview.

Tah-Dah! You place cash right into a Roth IRA by way of the backdoor whenever you aren’t eligible to contribute to it immediately. That’s why it’s known as a Backdoor Roth. You pay tax on a small quantity of earnings between contribution and conversion. That’s negligible relative to the good thing about having tax-free development in your contribution for a few years.

Troubleshooting

For those who adopted the steps and you aren’t getting the anticipated outcomes, right here are some things to examine.

Recent Begin

It’s greatest to comply with the steps recent in a single go. For those who already went forwards and backwards with completely different solutions earlier than you discovered this information, a few of your earlier solutions could also be caught someplace you not see. You’ll be able to delete them and begin over.

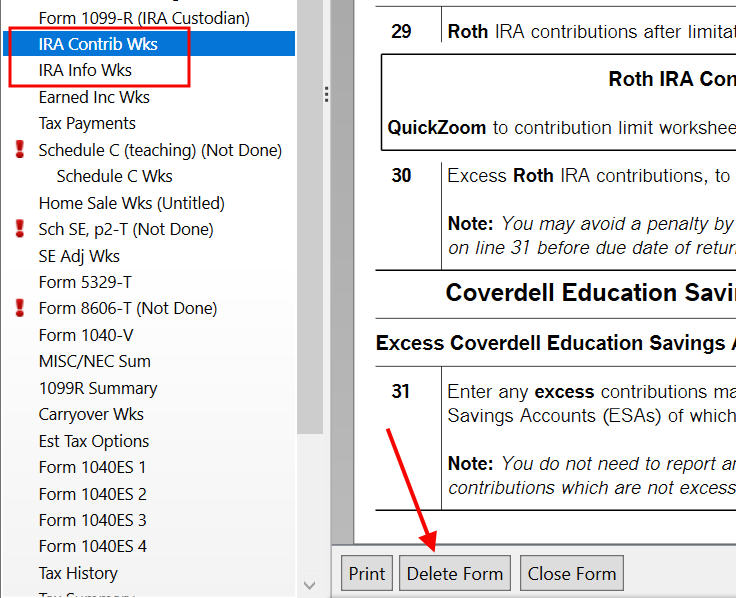

Click on on Types on the highest proper.

Discover “IRA Contrib Wks” and “IRA Data Wks” within the left navigation pane and click on on “Delete Kind” to delete them. Then you can begin over by following the steps above.

Conversion Is Taxed

For those who don’t have a retirement plan at work, you have got a better revenue restrict to take a deduction in your Conventional IRA contribution. Taking this deduction additionally makes your Roth IRA conversion taxable. You’ll be able to see this deduction on Schedule 1 Line 20, which reduces your AGI.

The taxable Roth IRA conversion and the deduction on your Conventional IRA contribution offset one another to create a wash. That is regular and it doesn’t trigger any issues whenever you certainly don’t have a retirement plan at work.

It’s much less complicated in the event you decline the tax deduction, which additionally makes your conversion non-taxable. See the Make It Nondeductible part.

Self vs Partner

If you’re married, be sure you don’t have the 1099-R and IRA contribution combined up between your self and your partner. For those who inadvertently entered two 1099-Rs issued to you rather than one for you and one on your partner, the second 1099-R to you’ll not match up with a Conventional IRA contribution made by your partner. For those who entered a 1099-R for each your self and your partner however you solely entered one Conventional IRA contribution, you can be taxed on one 1099-R.

Say No To Administration Charges

If you’re paying an advisor a proportion of your belongings, you might be paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.