A reader asks:

I’m 46 and plan to retire by 55. I’ve calculated that I’ll attain my retirement quantity in one other 6 years giving me a good buffer for retirement. I’ve a $500k mortgage at 5.625% with 28 years left. I’m snug with debt and don’t see a giant concern. I agree along with your ideas on liquidity, and inflation lowering the debt load. The one concern is retiring with the mortgage. We plan to maneuver after retirement and never keep at this home. I’ve run calculations and there’s no important distinction both means. Discretionary spending is barely lowered till retirement within the payoff situation however will increase by $50k over lifetime. It looks as if it’s in the end my determination. I’d admire any options on find out how to method it. -Raj

There are lots of good private finance angles to this query.

Initially I’m at all times fascinated as to why folks invariably decide 55 as their early retirement age. I get questions like this on a regular basis. The age is rarely 53 or 57. It’s at all times 55. Possibly folks identical to spherical numbers.

Paying off your mortgage early is a hotly debated private finance matter. Either side of the argument have robust emotions.

I’ve talked to loads of individuals who have paid off their mortgage early and none of them remorse it. It’s extra about peace of thoughts than a spreadsheet determination. That’s comprehensible.

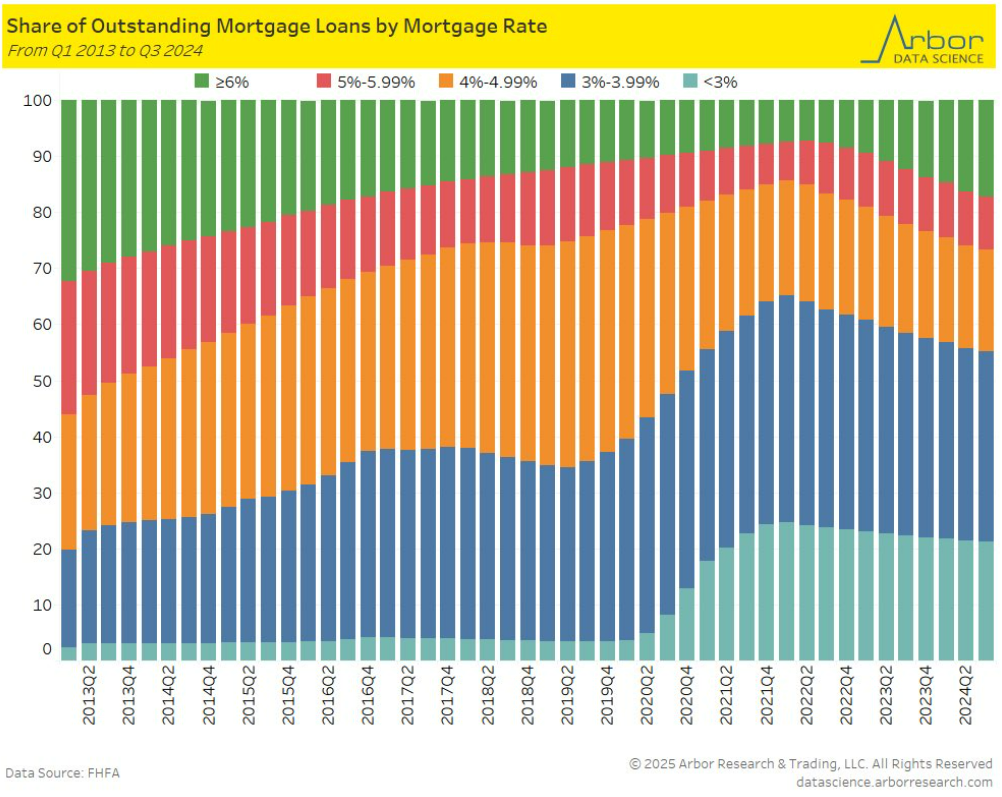

Nevertheless, I do really feel strongly that it mainly by no means is smart to repay a low-rate mortgage early. And loads of folks nonetheless have ultra-low charges from the pandemic:

Round 60% of all mortgages are 4% or much less. While you issue within the tax breaks and inflation it simply doesn’t make sense to me why you’ll wish to do away with debt at such favorable charges. You’ll need to pry my 3% mortgage from my chilly, lifeless fingers.

To every their very own I suppose.

Nevertheless, I feel the calculus adjustments when contemplating early retirement.

Retirement itself entails a seemingly endless checklist of unknowns — future returns, inflation, your lifespan, rates of interest, sudden occasions, household circumstances, sequence of returns, withdrawal charges, and so on. Retirement requires taking an enormous leap of religion. Retiring early solely provides to the diploma of problem.

I like the truth that Raj ran the numbers right here to grasp the monetary influence of paying off the debt.

As a lot as I hate paying off your mortgage early, I really like the concept of getting no mortgage in retirement. It affords an added margin of security and peace of thoughts.

One of many causes a fixed-rate mortgage is such a very good deal is as a result of your wages ought to develop over time. While you retire there aren’t any extra wages to depend on to assist shoulder that month-to-month mortgage burden.

However there’s one other piece of knowledge he shared with us right here that’s related — Raj and his spouse don’t plan on staying in the home once they retire. That adjustments the equation for me.

You nearly have to have a look at this from extra of a monetary asset perspective than a private finance angle.

In case you’re planning on promoting the home if you retire anyway I don’t see the necessity to repay your mortgage. Both means, you’ll obtain the proceeds from your property fairness if you promote. Sure, the quantity can be a lot bigger if you happen to paid it off earlier, however that additionally means you’ll be tying up that cash as an illiquid asset within the meantime.

Who is aware of what the housing market will appear to be if you go to promote in a decade? What if you happen to can’t promote as rapidly as you want to?

That is the type of selection the place there doubtless is not any proper or mistaken reply. All of it is dependent upon your relationship with debt, illiquidity and danger.

You additionally need to do not forget that 9 years is a very long time. Possibly your plans change. Possibly circumstances change.

I might put a premium on flexibility.

We lined this query on this week’s Ask the Compound:

Barry Ritholtz joined me on the present this week to debate questions on timing market corrections along with your financial savings account, how your portfolio ought to look heading into retirement, managing your mum or dad’s monetary plan and find out how to pressure your self into splurging slightly when you’ve got greater than sufficient cash.

Additional Studying:

How A lot is a 3% Mortgage Price?

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here shall be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or provide to supply funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency shouldn’t be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.