Structured fairness merchandise are packages of artificial funding devices particularly designed to attraction to wants that buyers understand aren’t met by out there securities. They’re usually packaged as asset allocation instruments that can be utilized to cut back portfolio danger. Structured fairness merchandise normally encompass an fairness index and a by-product (usually a put to guard draw back danger, although name choices will also be used to seize the upside of returns.

These methods have proved widespread with buyers as Morningstar’s choices trading-related fund classes had amassed $234 billion of belongings by the tip of February 2025. Their recognition flies within the face of financial concept—the sellers of the choices that shield the draw back danger demand a danger premium; thus, the patrons are paying an insurance coverage premium, which ought to be anticipated to cut back returns. Thus, even earlier than buying and selling prices and the upper expense ratios of those funds, buyers ought to count on to be disillusioned within the returns of such methods.

AQR’s Dan Villalon examined the efficiency of the 99 funds Morningstar’s options-trading associated classes that had histories going again to January 2020. For these 99 funds, he requested two questions:

-

Did their cumulative returns exceed that of passive U.S. equities (proxied by the S&P 500 Index)?

-

Have been their worst drawdowns much less extreme than that of passive U.S. equities?

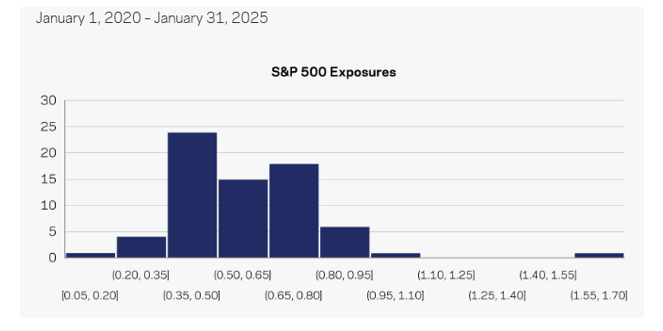

Villalon discovered that whereas all these funds delivered decrease returns than the fairness market, 86% did expertise smaller drawdowns than the market. Nonetheless, as Villalon defined, “There are less complicated methods to get returns decrease than equities with much less danger. For instance, as an alternative of placing $100 out there, an investor might make investments solely $70 and put the opposite $30 in Treasury Payments.” The next chart exhibits the distribution of the common fairness publicity of the 99 funds in his pattern.

Adjusting for every fund’s common publicity to the fairness market (the fund’s beta), he discovered that greater than two-thirds of all funds delivered decrease returns with extra danger than a easy mixture of passive equities and T-Payments. As well as, 81% of all of the funds had worse drawdowns than the easy “passive fairness plus money” mixture. And, even in comparison with this easy benchmark, solely 14% outperformed.

His findings led Villalon to conclude: “By and enormous, options-based methods haven’t been efficient instruments to realize higher danger/return outcomes. And that is unlikely to be some fluke of the previous 5 years. Financial concept would argue buyers ought to have anticipated this end result, and that they need to going ahead, too.“ He requested: “in case you’re involved with fairness danger, are you higher off a) utilizing choices or b) merely lowering your publicity to equities? Clearly, we imagine, based mostly on each concept and realized reality, that possibility b) is prone to be the higher selection.” In different phrases, these merchandise are advertising successes and funding failures.

Structured fairness investments aren’t the one merchandise which have been developed to take advantage of naïve retail buyers.

Structured Debt Merchandise

Due to the by-product part, structured merchandise have lengthy been promoted to buyers as debt securities. Full safety of the principal invested is usually provided, relying on the structured product. In different instances, solely restricted safety could also be offered, and even no safety. We’ll evaluation the empirical proof.

The Proof

Petra Vokata, writer of the October 2020 research “Engineering Lemons” masking January 2006-September 2015 and greater than 21,000 merchandise, discovered that buyers paid 7% on common in annual charges and misplaced 7% per yr relative to risk-adjusted benchmark returns.

Brian Henderson and Neil Pearson, authors of the research “The Darkish Facet of Monetary Innovation: A Case Examine of the Pricing of a Retail Monetary Product” printed within the Could 2011 difficulty of the Journal of Monetary Economics, discovered that the providing costs of 64 problems with a preferred retail structured fairness product had been nearly 8% larger on common than estimates of the merchandise’ honest market values obtained utilizing possibility pricing strategies, and the imply anticipated return estimate on the structured merchandise was barely under zero. The authors concluded that the issuing corporations both shrouded some features of their modern securities or launched complexity to take advantage of uninformed buyers.

Geng Deng, Ilan Guedj, Joshua Mallett, and Craig McCann, authors of the August 2011 research “The Anatomy of Principal Protected Absolute Return Barrier Notes,” examined the proof on ARBNs (absolute return barrier notes)—structured merchandise that assure to return the face worth of the be aware at maturity and pay curiosity if the underlying safety’s value doesn’t fluctuate excessively. The principal safety function ensures the total payback of the be aware’s face worth at maturity if the investor holds the be aware to maturity and the issuer doesn’t default. The research coated 214 ARBNs issued by six totally different funding banks. Most merchandise had been linked to indexes such because the S&P 500 and the Russell 2000. They discovered that the ARBNs’ honest value was roughly 4.5% under the precise difficulty costs. The authors additionally discovered that the yields on ARBNs had been decrease than the corresponding company yields. Many had been even decrease than the risk-free price!

Carole Bernard, Phelim Boyle, and William Gornall, authors of the research “Regionally-Capped Funding Merchandise and the Retail Investor” printed within the Summer season 2011 difficulty of the Journal of Derivatives, discovered that the contracts had been overpriced relative to their honest values by about 6.5% on common.

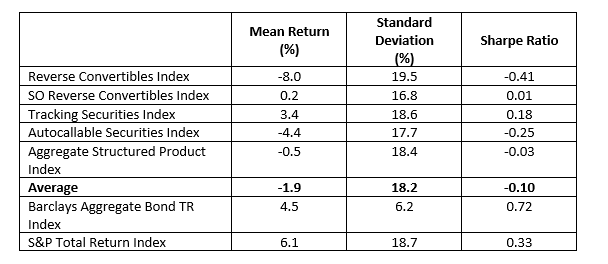

Geng Deng of Wells Fargo, Tim Dulaney, Tim Husson, Craig McCann, and Mike Yan, authors of the research “Ex Submit Structured Product Returns: Index Methodology and Evaluation” printed within the Summer season 2015 version of the Journal of Investing, analyzed the ex-post returns of greater than 20,000 particular person structured merchandise issued by 13 main funding corporations from 2007 by 2014. They constructed a structured product index and subindexes for reverse convertibles, single commentary (SO) reverse convertibles, monitoring securities, and autocallable securities by valuing every structured product of their database every day. The desk under presents the imply returns, normal deviations, and Sharpe ratios for the 5 structured product indexes in addition to the comparable figures for the S&P 500 Index and the Barclay Combination Bond Index.

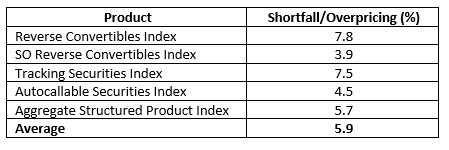

To isolate the efficiency outcomes from the problem of overpricing on the date of issuance, the authors additionally calculated the preliminary “shortfall” in pricing:

The outcomes clearly present that structured merchandise have dramatically underperformed different allocations to shares and bonds as a result of they’re overvalued. The authors concluded: “The outcomes of our index evaluation ought to trigger buyers and their advisers to keep away from structured merchandise.”

Investor Takeaways

Wall Avenue’s product machine is repeatedly pumping out fairy tales. Their product improvements will also be known as “fanciful tales of legendary deeds.” The one distinction is that they’re meant for adults. Just like the apple the Evil Queen provided Snow White, they’ve shiny options designed to entice naive buyers. And regardless of the numerous fanciful tales out there, they’ve one factor in widespread: Regardless of their seeming attraction, they’ve attributes that make them extra enticing to the fund sponsor or be aware issuer than the client. Thus, the primary takeaway is that structured merchandise ought to be prevented.