In each introductory finance class, you start with the notion of a risk-free funding, and the speed on that funding turns into the bottom on which you construct, to get to anticipated returns on dangerous property and investments. Actually, the usual apply that almost all analysts and buyers observe to estimate the danger free fee is to make use of the federal government bond fee, with the one variants being whether or not they use a brief time period or a long run fee. I took this estimation course of with no consideration till 2008, when throughout that disaster, I woke as much as the conclusion that it doesn’t matter what the textual content books say about risk-free investments, there are occasions when discovering an funding with a assured return can turn into an inconceivable process. Within the aftermath of that disaster, I wrote a collection of what I known as my nightmare papers, beginning with one titled, “What if nothing is danger free?”, the place I seemed on the chance that we reside in a world the place nothing is actually danger free. I used to be reminded of that paper a couple of weeks in the past, when Fitch downgraded the US, from AAA to AA+, a comparatively minor shift, however one with vital psychological penalties for buyers within the largest financial system on this planet, whose forex nonetheless dominates international transactions. After the score downgrade, my mailbox was inundated with questions of what this motion meant for investing, typically, and for company finance and valuation apply, particularly, and this put up is my try and reply all of them with one put up.

Threat Free Investments: Definition, Position and Measures

The place to begin a dialogue of risk-free charges is by answering the query of what you want for an funding to be risk-free, following up by seeing why that risk-free fee performs a central function in company finance and investing after which wanting on the determinants of that risk-free fee.

What’s a danger free funding?

For an funding to be risk-free, you’ve gotten really feel sure concerning the return you’ll make on it. With this definition in place, you possibly can already see that to estimate a danger free fee, that you must be particular about your time horizon, as an investor.

- An funding that’s danger free over a six month time interval won’t be danger free, when you have a ten 12 months time horizon. That’s as a result of you’ve gotten reinvestment danger, i.e., the proceeds from the six-month funding must be reinvested again on the prevailing rate of interest six months from now, a 12 months from now and so forth, till 12 months 10, and people charges should not identified on the time you are taking the primary funding.

- By the identical token, an funding that delivers a assured return over ten years won’t be danger free to an investor with a six month time horizon. With this funding, you face value danger, since despite the fact that you realize what you’ll obtain as a coupon or money stream in future intervals, for the reason that current worth of those money flows, will change as charges change. Throughout 2022, the US treasury didn’t default, however an investor in a 10-year US treasury bond would have earned a return of -18% on his or her funding, as bond costs dropped.

For an funding to be danger free then, it has to fulfill two situations. The primary is that there’s no danger that the issuer of the safety will default on their contractual commitments. The second is that the funding generates a money stream solely at your specified period, and with no intermediate money flows previous to that period, since these money flows will then need to be reinvested at future, unsure charges. For a five-year time horizon, then, you would want the speed on a five-year zero default-free zero coupons bond as your risk-free fee.

You can too draw a distinction between a nominal risk-free fee, the place you’re assured a return in nominal phrases, however with inflation being unsure, the returns you’re left with after inflation are now not assured, and an actual risk-free fee, the place you’re assured a return in actual phrases, with the funding is designed to guard you towards risky inflation. Whereas there may be an enchantment to utilizing actual risk-free charges and returns, we reside in a world of nominal returns, making nominal risk-free charges the dominant selection, in most funding evaluation.

Why does the risk-free fee matter?

By itself, a risk-free funding could seem unexceptional, and maybe even boring, however it’s a central element of investing and company finance:

- Asset Allocation: Buyers differ on danger aversion, with some extra keen to take danger than others. Whereas there are quite a few mechanisms that they use to mirror their variations on danger tolerance, the only and essentially the most highly effective is of their selection on how a lot to put money into dangerous property (shares, company bonds, collectibles and many others.) and the way a lot to carry in investments with assured returns over their time horizon (money, treasury invoice and treasury bonds).

- Anticipated returns for Dangerous Investments: The chance-free fee turns into the bottom on which you construct to estimate anticipated returns on all different investments. As an illustration, in case you learn my final put up on fairness danger premiums, I described the fairness danger premium as the extra return you’ll demand, over and above the danger free fee. Because the risk-free fee rises, anticipated returns on equities will likely be pushed up, and holding all else fixed, inventory costs will go down., and the reverse will happen, when risk-free charges drop.

- Hurdle charges for corporations: Utilizing the identical reasoning, greater risk-free charges push up the prices of fairness and debt for all corporations, and by doing so, increase the hurdle charges for brand new investments. As you improve hurdle charges, new investments must earn greater returns to be acceptable, and current investments can cross from being value-creating (incomes greater than the hurdle fee) to value-destroying (incomes much less).

- Arbitrage pricing: Arbitrage refers back to the chance that you could create risk-free positions by combining holdings in numerous securities, and the benchmark used to evaluate whether or not these positions are value-creating turns into the risk-free fee. Should you do assume that markets will value away this extra revenue, you then have the idea for the fashions which can be used to worth choices and different by-product property. That’s the reason the risk-free fee turns into an enter into choice pricing and ahead pricing fashions, and its absence leaves a vacuum.

Determinants

So, why do risk-free charges differ throughout time and throughout currencies? In case your reply is the Fed or central banks, you’ve gotten misplaced the script, for the reason that charges that central banks set are usually short-term, and inaccessible, for many buyers. Within the US, the Fed units the Fed Funds fee, an in a single day intra-bank borrowing fee, however US treasury charges, from the 3-month to 30-year, are set at auctions, and by demand and provide. To know the basics that decide these charges, put your self within the footwear of a purchaser of those securities, and think about the next:

- Inflation: Should you count on inflation to be 3% within the subsequent 12 months, it makes little sense to purchase a bond, even whether it is default free, that gives solely 2%. As anticipated inflation rises, you need to count on risk-free charges to rise, with or with out central financial institution actions.

- Actual Curiosity Charge: While you purchase a word or a bond, you’re giving up present consumption for future consumption, and it’s becoming that you simply earn a return for this sacrifice. It is a actual risk-free fee, and within the combination, it will likely be decided by the availability of financial savings in an financial system and the demand for these financial savings from companies and people making actual investments. Put merely, economies with a surplus of development investments, i.e., with extra actual development, ought to see greater actual rates of interest, in regular state, than stagnant or declining economies.

The popularity of those fundamentals is what provides rise to the Fisher equation for rates of interest or the danger free fee:

Nominal Threat-free Charge = (1 + Anticipated Inflation) (1+ Actual Curiosity Charge) -1 (or)

= Anticipated Inflation + Anticipated Actual Curiosity Charge (as an approximation)

In case you are questioning the place central banks enter this equation, they’ll accomplish that in 3 ways. The primary is that central banking actions can have an effect on anticipated inflation, at the least in the long run, with extra money-printing resulting in greater inflation. The second is central banking actions can, at the least on the margin, push charges above their fundamentals (anticipated inflation and actual rates of interest), by tightening financial coverage, and beneath their fundamentals by easing financial coverage. Since that is typically achieved by elevating or reducing the very quick time period charges set by the central financial institution, the central banking impact is prone to be better on the shorter period risk-free charges. The third is that central banks, by tightening or easing financial coverage, could have an effect on actual development within the close to time period, and by doing so, have an effect on actual charges.

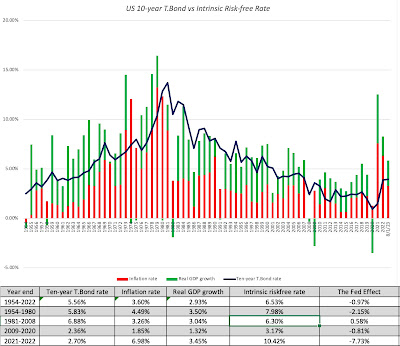

Having been fed the mythology that the Fed (or one other central financial institution) set rates of interest by buyers and the media, you could be unconvinced, however there is no such thing as a higher approach to present the vacancy of “the Fed did it” argument than to plot out the US treasury bond fee annually towards a crude model of the elemental risk-free fee, computed by including the precise inflation in a 12 months to the true GDP development fee that 12 months:

As you possibly can see, the first the reason why we noticed traditionally low charges within the 2008-2021 time interval was a mix of very low inflation and anemic actual development, and the primary motive that we have now seen charges rise in 2022 and 2023 is rising inflation. It’s true that nominal charges observe a smoother path than the intrinsic danger free charges, however that’s to be anticipated for the reason that ten-year charges signify anticipated values for inflation and actual development over the following decade, whereas my estimates of the intrinsic charges signify one-year numbers. Thus, whereas inflation jumped in 2021 and 2022 to six.98%, and buyers expect greater inflation sooner or later, they aren’t anticipating inflation to remain at these ranges for the following decade.

Threat Free Charge: Measurement

Now that we have now established what a risk-free fee is, why it issues and its determinants, allow us to have a look at how finest to measure that risk-free fee. We are going to start by the usual apply of utilizing authorities bond charges as riskfree charges, and why it collides with actuality, transfer on to look at why governments default and finish with an evaluation of how one can alter authorities bond charges for that default danger.

Authorities Bond Charges as Threat Free

I took my first finance class an extended, very long time in the past, and in the course of the risk-free fee dialogue, which lasted all of 90 seconds, I used to be advised to make use of the US treasury fee as a risk-free fee. Not solely was this a sign of how dollar-centric a lot of finance training was once, but additionally of how a lot religion there was that the US treasury was default-free. Since then, as finance has globalized, that lesson has been carried, nearly unchanged, into different currencies, the place we are actually being taught to make use of authorities bond charges in these currencies as risk-free charges. Whereas that’s handy, it’s price emphasizing two implicit assumptions that underlie why authorities bond charges are seen as risk-free:

- Management of the printing presses: If in case you have heard the rationale for presidency bond charges as risk-free charges, right here is the way it often goes. A authorities, when it borrows or points bonds in its native forex, preserves the choice to print more cash, when that debt comes due, and thus ought to by no means default. This assumption breaks down, after all, when nations share a standard forex, as is the case with the dozen or extra European nations that each one use the Euro as their home forex, and none of them has the facility to print forex at will.

- Belief in authorities: Governments that default, particularly on their home forex borrowings, are sending a sign that they can’t be trusted on their obligations, and the implicit assumption is that no authorities that has a selection would ever ship that sign. (Governments ship the identical sign after they default on their international forex debt/bonds, however they’ll at the least level to circumstances out of their management for doing so.)

The issue with these assumptions is that they’re at warfare with the information. As we famous in our nation danger dialogue, governments do default on their native forex borrowings and bonds, albeit at a decrease fee than they do on their international forex obligations.

In case you are questioning why a authorities that has a selection of not defaulting would select to default, it’s price remembering that printing more cash to repay native forex debt has a value of its personal, because it debases the forex, pushing up inflation. Inflation, particularly when it turns into stratospheric, causes buyers and customers to lose belief within the forex, and given a selection between default and debasement, many governments select the latter.

When you open the door to the opportunity of sovereign default in a neighborhood forex, it stands to motive {that a} authorities bond fee within the native forex could not at all times yield a risk-free fee for that forex. It’s also price noting that till 2008, buyers had that door firmly shut for some currencies, believing that some governments had been so reliable that they might not even think about default. Thus, the notion that the US or UK governments would default on their debt would have been unthinkable, however the 2008 disaster, along with the monetary injury it created, additionally opened up a belief deficit, which has made the unthinkable a actuality. Actually, you’ll be onerous pressed to search out any authorities that’s trusted the best way it was previous to this disaster, and that lack of belief additionally implies that the clock is ticking in the direction of expiration, for the “authorities bonds are danger free” argument.

When and Why Governments Default

Now that we have now established that governments can default, let’s have a look at why they default. The obvious motive is financial, the place a disaster and collapse in authorities revenues, from taxes and different sources, causes a authorities to be unable meet its obligations. The probability of this occurring must be affected by the next elements:

-

Concentrated versus Diversified Economic system: A authorities’s capability to cowl its debt obligations is a perform of the revenues it generates, and people revenues are prone to be extra risky in a rustic that will get its revenues from a single trade or commodity than it’s in a rustic with a extra various financial system. One measure of financial focus is the p.c of GDP that comes from commodity exports, and the image beneath supplies that statistic, by nation:

Supply: UNCTAD As you possibly can see, a lot of Africa, Latin America, the Center East and Asia are commodity dependent, successfully making them extra uncovered to default, with a downturn in commodity costs.

-

Diploma of Indebtedness: As with corporations, nations that borrow an excessive amount of are extra uncovered to default danger than nations that borrow much less. That mentioned, the query of what to scale borrowing to is an open query. One widely-used measure of nation indebtedness is the entire debt owed by the nation, as a p.c of its GDP. Primarily based on that statistic, essentially the most indebted nations are listed beneath:

As you possibly can see, this desk accommodates a mixture of nations, with some (Venezuela, Greece and El Salvador) at excessive danger of default and others (Japan, US, UK, Canada and France) seen as being at low danger of default.

- Tax Effectivity: It’s price remembering that governments don’t cowl debt obligations with gross home product or nation wealth, however with their revenues, which come primarily from accumulating taxes. Holding all else fixed, governments with extra environment friendly tax programs, the place most taxpayers comply and pay their share, are much less prone to default than governments with extra porous tax programs, the place tax evasion is extra the rule than the exception, and corruption places revenues into the fingers of personal gamers quite than the federal government.

There’s a second power at play, in sovereign defaults. In the end, a authorities that chooses to default is making a political selection, as a lot as it’s an financial one. When politics is purposeful, and events throughout the spectrum share within the perception that default must be a final resort, with vital financial prices, there will likely be shared incentive in avoiding default. Nevertheless, when politics turns into dysfunctional, and default is perceived as partisan, with one facet of the political divide perceived as shedding extra from default than the opposite, governments could default despite the fact that they’ve the sources to cowl their obligations.

As a lender to a authorities, you could not care about why a authorities defaults, however financial defaults usually signify extra intractable issues than defaults brought on by political dysfunction, which are usually solved as soon as the partisan kilos of flesh are extracted. For my part, the scores downgrades of the US authorities fall into the latter class, since they’re triggered by a uniquely US phenomenon, which is a debt restrict that needs to be reset every time the entire debt of the US approaches that worth. Since that reset needs to be authorised by the legislature, it turns into a mechanism for political standoffs, particularly when there’s a break up in govt and legislative energy. Actually, the primary downgrade of the US occurred greater than a decade in the past, when S&P lowered its sovereign score for the US from AAA to AA+ in 2011, after a debt-limit standoff on the time. The Fitch downgrade of the US, this 12 months, was triggered by a stand-off between the administration and Congress a couple of months in the past on the debt-limit, and one that could be revisited in a couple of weeks once more.

Measuring Authorities Default Threat

With that lead-in on sovereign default danger, allow us to have a look at how sovereign default danger will get measured, once more with the US as the main focus. The primary and most generally used measure of default danger is sovereign scores, the place scores businesses fee nations, simply as they do corporations, with a score scale that goes from AAA (Aaa) all the way down to D(default). Fitch, Moody’s and S&P all present sovereign scores for nations, with separate scores for international forex and native forex debt. With sovereign scores, the implicit assumption is that AAA (Aaa) rated nations have negligible or no default danger, and the scores businesses again this up with the statistic that no AAA rated nation has ever defaulted on its debt inside 15 years of getting a AAA score. That mentioned, the variety of AAA (Aaa) rated nations has dropped over time, and there are solely 9 nations left which have the highest score from all three scores businesses: Germany, Denmark, Netherlands, Sweden, Norway, Switzerland, Luxembourg, Singapore and Australia. Canada is rated AAA by two of the scores businesses, and after the Fitch downgrade, the US is rated Aaa solely by Moody’s, whereas the UK is AAA rated solely by S&P.

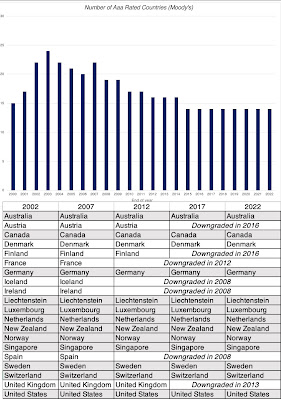

In a mirrored image of the instances, there have been two developments. The primary is that the variety of nations with the very best score has dropped over time, as will be seen within the graph beneath of nations with Aaa scores from Moody’s:

Second, even the scores businesses have turn into much less decisive about what a AAA sovereign score implies for default danger, particularly after the 2008 disaster, when S&P introduced that not all AAA nations had been equal, when it comes to default danger, thus admitting that every scores class included variations in default danger.

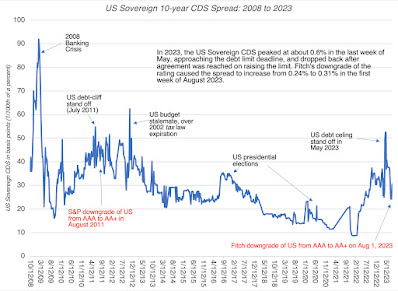

Should you acknowledge that default danger falls on a continuum, quite than within the discrete courses that scores assign, the sovereign CDS market provides you not solely extra nuanced estimates of default danger, however ones which can be mirror, on an up to date foundation, what buyers take into consideration a rustic’s default danger. The graph beneath accommodates the sovereign CDS spreads for the US going again to 2008, and mirror the market’s reactions to occasions (together with the 2011 and 2023 debt-limit standoffs) over time:

As you possibly can see, the debt-limit and tax legislation standoffs created spikes in 2011 and 2012, and, to a lesser extent, in early 2023, and that these spikes preceded the scores adjustments, and weren’t brought on by them, and that the market in a short time recovered from them. Actually, the Fitch scores downgrade has barely registered on the US CDS unfold, available in the market, indicating that buyers are neither shocked nor spooked by the scores downgrades (up to now).

Coping with Authorities Default Threat

It doesn’t matter what you concentrate on the Fitch downgrade of US authorities debt, the big-picture perspective is that we’re nearer to the state of affairs the place no entity is seen as default-free than we had been fifteen years in the past, and it might be solely a matter of time earlier than we have now to retire the notion that authorities bonds are default-free completely. The questions for buyers and analysts, if this happens, turns into sensible ones, together with how finest to estimate risk-free charges in currencies, when governments have default danger, and what the implications are for fairness danger premiums and default spreads.

1. Clear up authorities bond fee

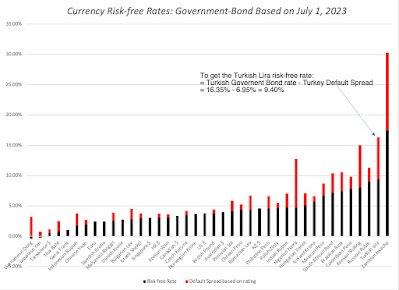

Take into account the 2 necessities that need to be met for a local-currency authorities bond fee for use as a risk-free fee in that forex. The primary is that the federal government bond needs to be broadly traded, making the rate of interest on the bond a fee set by demand and provide available in the market, quite than authorities edict. The second is that the federal government be perceived as default-free. The Swiss 10-year authorities bond fee, in July 2023, of 1.02% meets each standards, making it the risk-free fee in Swiss Francs. Utilizing an identical rationale, the German 10-year bund fee (in Euros) of two.47% turns into the risk-free fee in Euros. With the British pound, in case you stick with the Moody’s scores, issues get trickier. The federal government bond fee of 4.42% is now not risk-free, as a result of it has default danger embedded in it. To wash up that default danger, we estimated a default unfold of 0.64%, primarily based upon UK’s score of Aa3, and netted this unfold out from the federal government bond fee:

Threat-free Charge in British Kilos

= Authorities Bond Charge in Kilos – Default Unfold for UK = 4.42% – 0.64% = 3.78%

Extending this strategy to all currencies, the place there’s a authorities bond fee current, we get the riskfree charges in about 30 currencies:

For the reason that US nonetheless preserves a bond score of Aaa (for the second), with Moody’s, the US treasury fee of three.77% on July 1, 2023, was used because the riskfree fee in US {dollars}.

As you have a look at these charges, particularly in some rising market currencies, you ought to be cautious concerning the numbers you get, particularly for the reason that liquidity is gentle or non-existent in authorities bonds in these markets. Thus, it’s attainable that the Vietnamese Dong has the bottom risk-free fee on this planet in mid-2023, amongst all currencies, or it might mirror distortions within the Vietnamese authorities bond. One approach to test these riskier charges for reasonableness is to increase on the perception that the important thing driver of the danger free fee is inflation, and that in a world the place capital strikes to equalize actual returns, the variations in risk-free charges throughout currencies come from differential inflation In my put up on nation danger, Actually, as I argued in my put up on nation danger, you possibly can convert a riskfree fee in any forex right into a risk-free fee in one other forex by adjusting for the differential inflation between the currencies:

Thus, utilizing the IMF’s forecasted inflation charges for the US (3%) and Vietnam (5.08%), along with the US greenback risk-free fee of three.77% on July 1, 2023, yields a Vietnamese Dong risk-free fee of 5.87% (or 5.85% with the approximation).

Should you consider that S&P and Fitch are proper on their default danger assessments for the US, and that it ought to get a score decrease than Aaa (say Aa1), from Moody’s, the trail to getting a US risk-free fee has an added step. It’s a must to internet out the default unfold for the US treasury bond fee to get to a risk-free fee:

Riskfree Charge in US {dollars} = US Treasury Bond Charge – Default unfold on US T.Bond

Utilizing the sovereign CDS market’s estimate of 0.30% in August 2023, as an illustration, when the US treasury bond fee hit 4.10%, would have yielded a risk-free fee of three.80% for the US greenback.

2. Threat Premia

Should you focus simply on risk-free charges, you could discover it counter intuitive that a rise in default danger for a rustic lowers the danger free fee in its forex, however wanting on the huge image ought to clarify why it’s needed. A rise in sovereign default danger is often triggered by occasions that additionally improve danger premia in markets, pushing up authorities bond charges, fairness danger premiums and default spreads. Actually, in case you return to my put up on nation danger, it turns into the important thing driver of the extra danger premiums that you simply demand in nations:

You’ll discover that in my July 2023 replace, I used the implied fairness danger premium for the US of 5.00% as my estimate of a premium for a mature market, and assumed that any nation with a Aaa score (from Moody’s) would have the identical premium.

Since Moody’s stays the lone holdout on downgrading the US, I might use the identical strategy right this moment, however assuming that Moody’s downgrades the US from Aaa to Aa1, the strategy must be modified. The implied fairness danger premium for the US will nonetheless be my place to begin, however nations with Aaa scores will then be assigned fairness danger premiums decrease than the US, and that decrease fairness danger premium will turn into the mature market premium, for use to get fairness danger premiums for the remainder of the world. Utilizing the sovereign CDS unfold of 0.30% as the idea, only for illustration, the mature market premium would drop from 5.00%, in my July 2023 replace, to 4.58% (5.00% -1.42*.30%).

When secure havens turn into scarce…

Throughout crises, buyers seeks out security, however that pre-supposes that there’s a secure place to place your cash, the place you realize what you’ll make with certainty. The Fitch downgrade of the US, by itself, isn’t a market-shaking occasion, however along with a minus 18% return on the ten-year US treasury bond in 2022, these occasions undercut the notion that there’s a secure haven for buyers. When there is no such thing as a secure haven, market corrections after they occur won’t observe predictable patterns. Traditionally, when inventory costs have plunged, buyers have sought out US treasuries, pushing down yields and costs. However what if authorities securities are seen as dangerous? Is it any shock that the lack of belief in governments that has undercut the notion that they’re default-free has additionally given rise to a bunch of different funding choices, every claiming to be the following secure haven. Whereas my skepticism about crypto currencies and NFTs is effectively documented, a portion of their rise during the last 15 years has been pushed by the erosion of belief in establishments.

Conclusion

I began this put up by noting that we pay little consideration to risk-free charges in idea and in apply, taking it as a provided that it’s simple to estimate. As you possibly can see from this put up, that informal acceptance of what includes a risk-free funding generally is a recipe for catastrophe. In closing, listed here are a couple of basic propositions about risk-free charges which can be price maintaining in thoughts:

- Threat-free charges go along with currencies, not nations or governments: You estimate a risk-free fee in Euros or {dollars}, not one for the Euro-zone or america. Thus, in case you select to investigate a Brazilian firm in US {dollars}, the risk-free fee you need to use is the US greenback danger free fee, not the speed on Brazilian US-dollar denominated bond. It follows, subsequently, that the notion of a worldwide risk-free fee, touted by some, is fantasy, and utilizing the bottom authorities bond fee, ignoring currencies, as an estimate of this fee, is nonsensical.

- Funding returns must be currency-explicit and time-specific: Would you be okay with a 12% return on a inventory, in the long run? That query is unanswerable, till you specify the forex wherein you’re denominating returns, and the time you make the evaluation. An funding that earns 12%, in Zambian Kwacha, could also be making lower than the risk-free fee in Kwachas, however one which earns that very same return in Swiss Francs must be a slam-dunk as an funding. In the identical vein, an funding that earns 12% in US {dollars} in 2023 could effectively move muster as a superb funding, however an funding that earned 12% in US {dollars} in 1980 wouldn’t (for the reason that US treasury bond fee would have yielded greater than 10% on the time).

- Currencies are measurement mechanisms, not value-enhancer or destroyers: A very good monetary evaluation or valuation must be currency-invariant, with no matter conclusion you draw whenever you do your evaluation in a single forex carrying over into the identical evaluation, achieved in numerous currencies. Thus, switching from a forex with a excessive risk-free fee to 1 with a a lot decrease risk-free fee will decrease your low cost fee, however the inflation differential that causes this to occur will even decrease your money flows by a proportional quantity, leaving your worth unchanged.

- Nobody (together with central banks) can’t combat fundamentals: Central banks and governments that assume that they’ve the facility to lift or decrease rates of interest by edict, and the buyers who make investments on that foundation, are being delusional. Whereas they’ll nudge charges on the margin, they can not combat fundamentals (inflation and actual development), and after they do, the basics will win.

YouTube Video