On this put up, I’ll carry collectively two disparate and really completely different matters that I’ve written about up to now. The primary is the position that money holdings play in a enterprise, an extension of the dividend coverage query, with an examination of why companies usually mustn’t pay out what they’ve out there to shareholders. In my courses and writing on company finance, I take a look at the motives for companies retaining money, in addition to how a lot money is an excessive amount of money. The second is bitcoin, which might be seen as both a foreign money or a collectible, and in a collection of posts, I argued that bitcoin can solely be priced, not valued, making debates about whether or not to purchase or to not purchase solely a perform of notion. Actually, I’ve steered away from saying a lot about bitcoin in recent times, although I did point out it in my put up on different investments as a collectible (like gold) that may be added to the selection combine. Whereas there could also be little that seemingly connects the 2 matters (money and bitcoin), I used to be drawn to jot down this put up due to a debate that appears to be heating up on whether or not firms ought to put some or a big portion of their money balances into bitcoin, with the success of MicroStrategy, a high-profile beneficiary of this motion, driving a few of this push. I consider that it’s a horrible concept for many firms, and earlier than Bitcoin believers get riled up, my reasoning has completely nothing to do with what I consider bitcoin as an funding and extra to do with how little I belief company managers to time trades proper. That stated, I do see a small subset of firms, the place the holding bitcoin technique is sensible, so long as there are guardrails on disclosure and governance.

Money in a Going Concern

In a world the place companies can increase capital (fairness or debt) at honest costs and in a well timed method, there may be no need to carry money, however that’s not the world we dwell in. For quite a lot of causes, some inner and a few exterior, firms are sometimes unable or unwilling to boost capital from markets, and with that constraint in place, it’s logical to carry money to fulfill unexpected wants. On this part, I’ll begin by laying out the position that money holdings play in any enterprise, and study how a lot money is held by firms, damaged down by groupings (regional, dimension, trade).

A Monetary Stability Sheet

To know the place of money in a enterprise, I’ll begin with a monetary stability sheet, a construction for breaking down a enterprise, public or non-public:

On the asset aspect of the stability sheet, you begin with the working enterprise or companies that an organization is in, with a bifurcation of worth into worth from investments already made (assets-in-place) and worth from investments that the corporate expects to make sooner or later (progress belongings). The second asset grouping, non-operating belongings, features a vary of investments that an organization might make, generally to reinforce its core companies (strategic investments), and generally as aspect investments, and thus embrace minority holdings in different firms (cross holdings) and even investments in monetary belongings. Typically, as is the case with household group firms, these cross holdings could also be a mirrored image of the corporate’s historical past as a part of the group, with investments in different group firms for both capital or company management causes. The third grouping is for money and marketable securities, and that is meant particularly for investments that share two widespread traits – they’re riskless or near riskless insofar as holding their worth over time and they’re liquid within the sense that they are often transformed to money shortly and with no penalty. For many firms, this has meant investing money in short-term bonds or payments, issued by both governments (assuming that they’ve little default danger) or by giant, secure firms (within the type of business paper issued by extremely rated companies).

Notice that there are two sources of capital for any enterprise, debt or fairness, and in assessing how levered a agency is, traders take a look at the proportion of the capital that comes from every:

- Debt to Fairness = Debt/ Fairness

- Debt to Capital = Debt/ (Debt + Fairness)

Actually, there are lots of analysts and traders who estimate these debt ratios, utilizing web debt, the place they internet the money holdings of an organization towards the debt, with the rationale, merited or not, that money can be utilized to pay down debt.

- Web Debt to Fairness = (Debt-Money)/ Fairness

- Debt to Capital = (Debt-Money)/ (Debt + Fairness)

All of those ratios might be computed utilizing accounting e book worth numbers for debt and fairness or with market worth numbers for each.

The Motives for holding Money

In my introductory finance courses, there was little dialogue of money holdings in firms, outdoors of the periods on working capital. In these periods, money was launched as a lubricant for companies, essential for day-to-day operations. Thus, a retail retailer that had scores of money prospects, it was argued, wanted to carry more money, usually within the type of foreign money, to fulfill its transactional wants, than an organization with company suppliers and enterprise prospects, with predictable patterns in operations. Actually, there have been guidelines of thumb that had been developed on how a lot money an organization wanted to have for its operations. Because the world shifts away from money to digital and on-line funds, this want for money has decreased, however clearly not disappeared. The one carve out is the monetary providers sector, the place the character of the enterprise (banking, buying and selling, brokerage) requires firms within the sector to carry money and marketable securities as a part of their working companies.

If the one purpose for holding money was to cowl working wants, there can be no approach to justify the tens of billions of {dollars} that many firms maintain; Apple alone has usually had money balances that exceeded $200 billion, and the opposite tech giants will not be far behind. For some firms, a minimum of, the rationale for holding far more money than justified by their working wants is that it might function as a shock absorber, one thing that they’ll fall again on in periods of disaster or to cowl sudden bills. That’s the reason that cyclical and commodity companies have usually supplied for holding giant money balances (as a p.c of their total agency worth), since a recession or a commodity value downturn can shortly flip income to losses.

Utilizing the company life cycle construction also can present perception into how the motives for holding money can change as an organization ages.

For start-ups, which might be both pre-revenue or have very low revenues, money is required to maintain the enterprise working, since staff need to be paid and bills lined. Younger companies which might be money-losing and with giant unfavourable money flows, maintain money to cowl future money circulate wants and to fend off the danger of failure. In impact, these companies are utilizing money as life preservers, the place they’ll make it via intervals the place exterior capital (enterprise capital, particularly) dries up, with out having to promote their progress potential at cut price basement costs. As companies begin to earn a living, and enter excessive progress, money has use as a enterprise scalar, for companies that need to scale up shortly. In mature progress, money acquires optionality, helpful in permitting the enterprise to seek out new markets for its merchandise or product extensions. Mature companies generally maintain money as youth serum, hoping that it may be used to make once-in-a-lifetime investments that will take them again to their progress days, and for declining companies, money turns into a liquidation supervisor, permitting for the orderly compensation of debt and sale of belongings.

There’s a remaining rationale for holding money that’s rooted in company governance and the management and energy that comes from holding money. I’ve lengthy argued that absent strain from shareholders, managers at most publicly traded companies would select to return little or no of the money that they generate, since that money stability not solely makes them extra wanted (by bankers and consultants who’re endlessly creative about makes use of that the money might be put to) but in addition offers them the ability to construct company empires and create private legacies.

Company Money Holdings

Given the multitude of causes for holding money, it ought to come as no shock that publicly traded firms around the globe have important money balances. Main into July 2025, for example, international non-financial-service companies held virtually $11.4 trillion in money and marketable securities; monetary service companies held much more in money and marketable securities, however these holdings, as we famous earlier, can signify their enterprise wants. Utilizing our earlier breakdown of the asset aspect of the stability sheet into money, non-operating and working belongings, that is what non-financial service companies within the mixture appeared like in e book worth phrases (international and simply US companies):

Notice that money is about 11% of the e book worth of complete belongings, within the mixture, for international companies, and about 9% of the e book worth of complete belongings, for US companies. World companies do maintain the next proportion of their worth in non-operating belongings, however US companies are extra lively on the acquisition entrance, explaining why goodwill (which is triggered virtually solely by acquisitions) is larger at US companies.

The everyday publicly traded agency holds a big money stability, however there are important variations in money holdings, by sector. Within the desk beneath, I take a look at money as a p.c of complete belongings, a e book worth measure, in addition to money as a p.c of agency worth, computed by aggregating market values:

As you possibly can see, know-how companies, which presumably face extra uncertainty about their future maintain far more money as a p.c of e book worth, however the worth that the market attaches to their progress brings down money as a p.c of agency worth. Utilities, regulated and infrequently steady companies, have a tendency to carry the least money, each in e book and market phrases.

Breaking down the pattern by area, I take a look at money holdings, as a p.c of complete belongings and companies, throughout the globe:

The variations throughout the globe might be defined by a mixture of market entry, with international locations in elements of the world the place it may be tough to entry capital (Latin America, Jap Europe, Africa) holding more money. As well as, and company governance, with money holdings being larger in elements of the world (China, Russia) the place shareholders have much less energy over managers.

Given the sooner dialogue of how the motives for holding money can fluctuate throughout the life cycle, I broke the pattern down by age decile, with age measured from the yr of founding, and checked out money holdings, by decile:

The outcomes are combined, with money holdings as a p.c of complete belongings being greater for the youthful half of the pattern (the highest 5 deciles) than for the older half, however the is not any discernible sample, when money is measured as a p.c of agency worth (market). Put easy, firms throughout the life cycle maintain money, although with completely different motives, with the youngest companies holding on to money as lifesavers (and for survival) and the older companies maintaining money within the hopes that they’ll use it to rediscover their youth.

The Magic of Bitcoin

I’ve been educating and dealing with investments now for 4 a long time, and there was no funding that has obtained as a lot consideration from each traders and the monetary press, relative to its precise worth, as has bitcoin. A few of the draw has come from its connections to the digital age, however a lot of it has come from its speedy rise in value that has made many wealthy, with intermittent collapses which have made simply as many poor. I’m a novice with regards to crypto, and whereas I’ve been open about the truth that it isn’t my funding choice, I perceive its draw, particularly for youthful traders.

The Brief, Eventful Historical past of Bitcoin

The origin story for Bitcoin issues because it helps us perceive each its attraction and its construction. It was born in November 2008, two months into one of many worst monetary crises of the final century, with banks and governments seen as largely answerable for the mess. Not surprisingly, Bitcoin was constructed on the presumption that you simply can’t belief these establishments, and its largest innovation was the blockchain, designed as a manner of crowd-checking transactions and preserving transaction integrity. I’ve lengthy described Bitcoin as a foreign money designed by the paranoid for the paranoid, and I’ve by no means meant that as a critique, since within the untrustworthy world that we dwell in, paranoia is a justifiable posture.

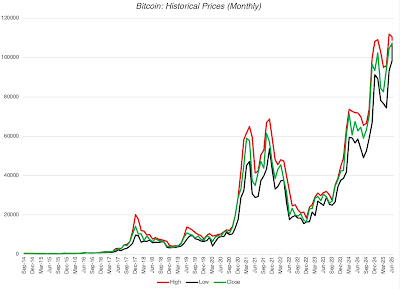

From its humble beginnings, the place only some (largely tech geeks) had been conscious of its existence, Bitcoin has collected evangelists, who argue that it’s the foreign money of the long run, and speculators who’ve used its wild value swings to make and lose tens of thousands and thousands of {dollars}. Within the chart beneath, I take a look at the value of bitcoin during the last decade, as its value has elevated from lower than $400 in September 2014 to greater than $110,000 in June 2025:

Alongside the way in which, Bitcoin has additionally discovered some acceptance as a foreign money, first for unlawful actions (medication on the Silk Street) after which because the foreign money for international locations with failed fiat currencies (like El Salvador), however even Bitcoin advocates will agree that its use in transactions (because the medium of change) has not saved tempo with its progress as a speculative commerce.

Pricing Bitcoin

In a put up in 2017, I divided investments into 4 teams – belongings that generate money flows (shares, bonds, non-public companies), commodities that can be utilized to supply different items (oil, iron ore and so forth), currencies that act as mediums of change and shops of worth and collectibles which might be priced based mostly on demand and provide:

Chances are you’ll disagree with my categorization, and there are shades of grey, the place an funding might be in multiple grouping. Gold, for example, is each a collectible of lengthy standing and a commodity that has particular makes use of, however the former dominates the latter, with regards to pricing. In the identical vein, crypto has a various array of gamers, with just a few assembly the asset take a look at and a few (like ethereum) having commodity options. The distinction between the completely different funding courses additionally permits for a distinction between investing, the place you purchase (promote) an funding whether it is underneath (over) valued, and buying and selling, the place you purchase (promote) an funding for those who anticipate its value to go up (down). The previous is a selection, although not a requirement, with an asset (shares, bonds or non-public companies), although there could also be others who nonetheless commerce that asset. With currencies and collectibles, you possibly can solely commerce, making judgments on value route, which, in flip, requires assessments of temper and momentum, moderately than fundamentals.

With bitcoin, this classification permits us to chop via the various distractions that pop up throughout discussions of its pricing degree, since it may be framed both as a foreign money or a collectible, and thus solely priced, not valued. Seventeen years into its existence, Bitcoin has struggled on the foreign money entrance, and whereas there are pockets the place it has gained acceptance, its design makes it inefficient and its volatility has impeded its adoption as a medium of change. As a collectible, Bitcoin begins with the benefit of shortage, restricted as it’s to 21 million items, however it has not fairly measured up, a minimum of thus far, with regards to holding its worth (or rising it) when monetary belongings are in meltdown mode. In each disaster since 2008, Bitcoin has behaved extra like dangerous inventory, falling way over the typical inventory, when shares are down, and rising extra, once they get well. I famous this in my posts wanting on the efficiency of investments in each the primary quarter of 2020, when COVID laid waste to markets, and in 2022, when inflation ravaged inventory and bond markets. That stated, it’s nonetheless early in its life, and it’s solely potential that it might change its habits because it matures and attracts in a wider investor base. The underside line is that discussions of whether or not Bitcoin is affordable or costly are sometimes pointless and generally irritating, because it relies upon virtually solely in your perspective on how the demand for Bitcoin will shift over time. For those who consider that its attraction will fade, and that it will likely be displaced by different collectibles, even perhaps within the crypto house, you’ll be within the brief promoting camp. In case you are satisfied that its attraction is not going to simply endure but in addition attain contemporary segments of the market, you might be on stable floor in assuming that its value will proceed to rise. It behooves each teams to confess that neither has a monopoly on the reality, and it is a disagreement about buying and selling and never an argument about fundamentals.

The MicroStrategy Story

It’s plain that one firm, MicroStrategy, has accomplished extra to advance the company holding of Bitcoin than every other, and that has come from 4 elements;

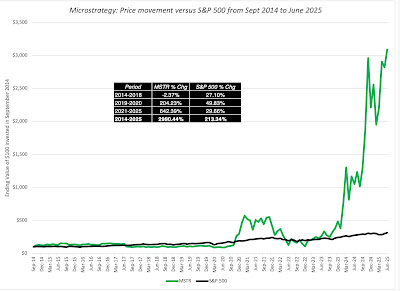

- A inventory market winner: The corporate’s inventory value has surged during the last decade, making it the most effective performing shares on the US exchanges:

It’s price noting that nearly all the outperformance has occurred on this decade, with the winnings concentrated into the final two years.

-

With the rise (more and more) tied to Bitcoin: Virtually all of MicroStrategy’s outperformance has come from its holdings of bitcoin, and never come from enhancements in enterprise operations. That comes via within the graph beneath, the place I take a look at the costs of MicroStrategy and Bitcoin since 2014:

Notice that MicroStrategy’s inventory value has gone from being barely negatively correlated with Bitcoin’s value between 2014-2018 to monitoring Bitcoin in newer years.

- And disconnected from operations: In 2014, MicroStrategy was seen and priced as a software program/providers tech firm, albeit a small one with promise. Within the final decade, its working numbers have stagnated, with each revenues and gross income declining, however throughout the identical interval, its enterprise worth has soared from $1 billion in 2014 to greater than greater than $100 billion in July 2025:

It’s clear now that anybody investing in MicroStrategy at its present market cap (>$100 billion) is making a bitcoin play.

- With a high-profile “bitcoin evangelist” as CEO: MicroStrategy’s CEO, Michael Saylor, has been a vocal and extremely seen promoter of bitcoin, and has transformed a lot of his shareholders into fellow-evangelists and satisfied a minimum of a few of them that he’s prescient in detecting value actions. In latest years, he has been public in his plans to concern rising quantities of inventory and utilizing the proceeds to purchase extra bitcoin.

In sum, MicroStrategy is now much less a software program firm and extra a Bitcoin SPAC or closed-end fund, the place traders are trusting Saylor to make the suitable buying and selling judgments on when to purchase (and promote) bitcoin, and hoping to profit from the income.

The “Put your money in bitcoin” motion

For traders in different publicly traded firms which have struggled delivering worth of their working companies, MicroStrategy’s success with its bitcoin holdings appears to point a misplaced alternative, and one that may be remedied by leaping on the bandwagon now. In latest months, even excessive profile firms, like Microsoft, have seen shareholder proposals pushing them to desert their standard apply of holding money in liquid and close-to-riskless investments and shopping for Bitcoin as a substitute. Microsoft’s shareholders soundly rejected the proposal, and I’ll begin by arguing that they had been proper, and that for many firms, investing money in bitcoin doesn’t make sense, however within the second half, I’ll carve out the exceptions to this rule.

The Common Precept: No to Bitcoin

As a basic rule, I feel it isn’t solely a nasty concept for many firms to take a position their money in bitcoin, however I’d go additional and likewise argue that they need to banned from doing so. Let me hasten so as to add that I’d make this assertion even when I used to be bullish on Bitcoin, and my argument would apply simply as strongly to firms contemplating shifting their money into gold, Picassos or sports activities franchises, for 5 causes:

- Bitcoin doesn’t meet the money motives: Earlier on this put up, I famous the the reason why an organization holds money, and, particularly, as a shock absorber, steadying a agency via unhealthy instances. Changing low-volatility money with high-volatility bitcoin would undercut this goal, analogous to changing your shock absorbers with pogo sticks. Actually, given the historical past of shifting with inventory costs, the worth of bitcoin on an organization’s stability sheet will dip at precisely the instances the place you would want it most for stability. The argument that bitcoin would have made so much greater returns for firms than holding money is a non-starter, since firms ought to maintain money for security.

- Bitcoin can step in your working enterprise narrative: I’ve lengthy argued that profitable companies are constructed round narratives that incorporate their aggressive benefits. When firms which might be in good companies put their money in bitcoin, they danger muddying the waters on two fronts. First, it creates confusion about why an organization with a stable enterprise narrative from which it might derive worth would search to earn a living on a aspect sport. Second, the ebbs and flows of bitcoin can have an effect on monetary statements, making it harder to attach working outcomes to story traces.

- Managers as merchants? When firms are given the license to maneuver their money into bitcoin or different non-operating investments, you might be trusting managers to get the timing proper, by way of when to purchase and promote these investments. That belief is misplaced, since high managers (CEOs and CFOs) are for probably the most half horrible merchants, usually shopping for on the market highs and promoting at lows.

- Depart it to shareholders: Even in case you are unconvinced by the primary three causes, and you’re a bitcoin advocate or fanatic, you’ll be higher served pushing firms that you’re a shareholder in, to return their money to you, to put money into bitcoin, gold or every other funding at your chosen time. Put merely, for those who consider that Bitcoin is the place to place your cash, why would you belief company managers to do it for you?

- License for abuse: I’m a skeptic with regards to company governance, believing that managerial pursuits are sometimes at odds with what’s good for shareholders. Giving managers the permission to commerce crypto tokens, bitcoin or different collectibles can open the door for self dealing and worse.

Whereas I’m a fan of letting shareholders decide the boundaries on what managers can or can’t do, I consider that the SEC (and different inventory market regulators around the globe) might have to change into extra express of their guidelines on what firms can (and can’t) do with money.

The Carveouts

I do consider that there are instances if you, as a shareholder, could also be at peace with the corporate not solely investing money in bitcoin, however doing so actively and aggressively. Listed below are 4 of my carveouts to the overall rule on bitcoin:

- The Bitcoin Savant: In my earlier description of MicroStrategy, I argued that shareholders in MicroStrategy haven’t solely gained immensely from its bitcoin holdings, but in addition belief Michael Saylor to commerce bitcoin for them. Briefly, the notion, rightly or wrongly, is that Saylor is a bitcoin savant, understanding the temper and momentum swings higher than the remainder of us. Generalizing, if an organization has a frontrunner (often a CEO or CFO) who’s seen as somebody who is nice at gauging bitcoin value route, it’s potential that shareholders within the firm could also be prepared to grant her or him the license to commerce bitcoin on their behalf. That is, after all, not distinctive to bitcoin, and you may argue that traders in Berkshire Hathaway have paid a premium for its inventory, and allowed it leeway to carry and deploy immense quantities of money as a result of they trusted Warren Buffett to make the suitable funding judgments.

- The Bitcoin Enterprise: For some firms, holding bitcoin could also be half and parcel of their enterprise operations, much less an alternative to money and extra akin to stock. PayPal and Coinbase, each of which maintain giant quantities of bitcoin, would fall into this carveout, since each firms have enterprise that requires that holding.

- The Bitcoin Escape Artist: As a few of you might remember, I famous that Mercado Libre, a Latin American on-line retail agency, is on my purchase listing, and it’s a firm with a reasonably substantial bitcoin holding. Whereas a part of that holding might relate to the working wants of their fintech enterprise, it’s price noting that Mercado Libre is an Argentine firm, and the Argentine peso has been a dangerous foreign money to carry on to, making bitcoin a viable possibility for money holdings. Generalizing, firms in international locations with failed currencies might conclude that holding their money in bitcoin is much less dangerous than holding it within the fiat currencies of the areas they function in.

- The Bitcoin Meme: There’s a remaining grouping of firms that I’d put within the meme inventory class, with AMC and Gamestop heading that listing. These firms have working enterprise fashions which have damaged down or have declining worth, however they’ve change into, by design or via accident, buying and selling performs, the place the value bears no resemblance to working fundamentals and is as a substitute pushed by temper and momentum. If that’s the case, it might make sense for these firms to throw within the towel on working companies solely and as a substitute make themselves much more into buying and selling automobiles by shifting into bitcoin, with the elevated volatility including to their “meme” attract.

Even with these exceptions, although, I feel that you simply want guardrails earlier than signing off on opening the door to letting firms maintain bitcoin.

- Shareholder buy-in: In case you are a publicly traded firm contemplating investing some or a lot of the corporate’s money in bitcoin, it behooves you to get shareholder approval for that transfer, since it’s shareholder money that’s being deployed.

- Transparency about Bitcoin transactions/holdings: As soon as an organization invests in bitcoin, it’s crucial that there be full and clear disclosure not solely on these holdings but in addition on buying and selling (shopping for and promoting) that happens. In any case, if it’s a firm’s declare that it might time its bitcoin trades higher than the typical investor, it ought to reveal the costs at which it purchased and bought its bitcoin.

- Clear mark-to-market guidelines: If an organization invests its money in bitcoin, I’ll assume that the worth of that bitcoin shall be risky, and accounting guidelines have to obviously specify how that bitcoin will get marked to market, and the place the income and losses from that marking to market will present up within the monetary statements.

As bitcoin costs rise to all time highs, there may be the hazard that regulators and rule-writers shall be lax of their rule-writing, opening the door to company scandals sooner or later.

Cui Bono?

Bitcoin advocates have been aggressively pushing each institutional traders and firms to incorporate Bitcoin of their funding decisions, and it’s true that a minimum of first sight, they are going to profit from that inclusion. Increasing the demand for bitcoin, an funding with a hard and fast provide, will drive the value upwards, and present bitcoin holders will profit. Actually, a lot of the rise of bitcoin because the Trump election in November 2024 might be attributed to the notion that this administration will ease the way in which for firms and traders to affix within the crypto bonanza.

For bitcoin holders, rising institutional and company buy-in to bitcoin might appear to be an unmixed blessing, however there shall be prices that, in the long term, might lead a minimum of a few of them to remorse this push:

- Completely different investor base: Drawing in institutional traders and firms into the bitcoin market is not going to solely change its traits, however put merchants who might know easy methods to play the market now at an obstacle, because it shifts dynamics.

- Right here at present, gone tomorrow? Bitcoin could also be in vogue now, however what is going to the results be if it halves in value over the subsequent six months? Establishments and firms are notoriously ”sheep like” of their habits, and what’s in vogue at present could also be deserted tomorrow. For those who consider that bitcoin is risky now, including these traders to the combination will put that volatility on steroids.

- Change asset traits: Each funding class that has been securitized and introduced into institutional investing has began behaving like a monetary asset, shifting extra with shares and bonds than it has traditionally. This occurred with actual property within the Nineteen Eighties and Nineties, with mortgage backed securities and different tradable variations of actual property, making it much more correlated with inventory and bonds, and fewer of a stand alone asset.

If the tip sport for bitcoin is to make it millennial gold, another or worthy add-on to monetary belongings, the higher course can be steer away from institution buy-in and construct it up with another investor base, pushed by completely different forces and motives than inventory and bond markets.

YouTube Video