I’ve made no secret of my disdain for ESG, an over-hyped and over-sold acronym, that has been a gravy prepare for a complete host of gamers, together with fund managers, consultants and lecturers. In response, I’ve been advised that the issue will not be with the concept of ESG, however in its measurement and utility, and that influence investing is the answer to each market and society’s issues. Affect investing, after all, is investing in companies and property primarily based on the expectation of not simply incomes monetary returns, but additionally creating constructive change in society.

It’s human nature to need to make the world a greater place, however does influence investing have the influence that it goals to create? That’s the query that I hope to handle on this submit. In the middle of the submit, I’ll work with two presumptions. The primary is that the issues for society that influence investing are aiming to handle are actual, whether or not or not it’s local weather change, poverty or wealth inequality. The second is that influence traders have good intentions, aiming to make a constructive distinction on this planet. I perceive that there can be some who really feel that these presumptions are conceding an excessive amount of, however I need to hold my concentrate on the mechanics and penalties of influence investing, quite than bask in debates about society’s issues or query investor motives.

Affect Investing: The What, The Why and the How!

Affect investments are investments made with the intent of producing advantages for society, alongside a monetary return. That generic definition will not be solely broad sufficient to cowl a variety of influence investing actions and motives, however has additionally been with us because the starting of time. Traders and enterprise individuals have usually thought of social payoffs when making investments, although they’ve differed on the social outcomes that they search, and the diploma to which they’re prepared to sacrifice the underside line to attain these outcomes.

Within the final twenty years, this age-old investing habits has come underneath the umbrella of influence investing, with a number of books on the right way to do it proper, tutorial analysis on how it’s working (or not), and organizations devoted to advancing its mission. The World Affect Investing Community (GIIN), a non-profit that tracks the expansion of this investing motion, estimated that greater than $1.16 trillion was invested by influence traders in 2021, with a various vary of traders:

|

| World Affect Investing Community, 2022 Report |

Not surprisingly, the steadiness between social influence and monetary return desired by traders, varies throughout investor teams, with some extra targeted on the previous and others the latter. In a survey of influence traders, GIIN elicited these responses on what forms of returns traders anticipated to earn on their influence investments, damaged down by teams:

|

| World Affect Investing Community, 2020 Report |

Nearly two thirds of influence traders imagine that they’ll eat their cake and have it too, anticipating to earn as a lot or greater than a risk-adjusted return, whilst they do good. That delusion operating deepest amongst pension funds, insurance coverage firms, for-profit fund managers and diversified monetary traders, who additionally occur to account for 78% of all influence investing funds.

If having a constructive influence on society, whereas incomes monetary returns, is what characterizes influence investing, it might take certainly one of three varieties:

- Inclusionary Affect Investing: On the inclusionary path, influence traders hunt down companies or firms which are most probably to have a constructive influence on no matter societal drawback they’re looking for to resolve, and spend money on these firms, usually prepared to pay increased costs than justified by the monetary payoffs on the enterprise.

- Exclusionary Affect Investing: Within the exclusionary segue, influence traders promote shares in companies that they personal, or refuse to purchase shares in these companies, if they’re seen as worsening the focused societal drawback.

- Evangelist Affect Investing: Within the activist variant, influence traders purchase stakes in companies that they view as contributing to the societal drawback, after which use that possession stake to push for adjustments in operations and habits, to cut back the unfavorable social or environmental influence.

The impact of influence investing within the inclusionary and exclusionary paths is via the inventory worth, with the shopping for (promoting) in inclusionary (exclusionary) investing pushing inventory costs up (down), which, in flip, decreases (will increase) the prices of fairness and capital at these companies. The adjustments in prices of funding then present up in investing selections and progress decisions at these firms, with good firms increasing and unhealthy firms shrinking.

With evangelist influence investing, influence traders intention to get a crucial mass of shareholders as allies in pushing for adjustments in how firms function, shifting the corporate away from actions that create unhealthy penalties for society to people who have impartial or good penalties.

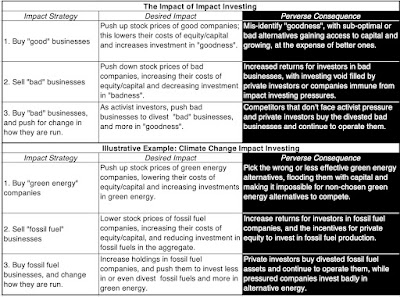

As you possibly can see, for influence investing to have an effect on society, a sequence of hyperlinks need to work, and if all or any of them fail, there’s the very actual potential that influence investing can have perverse penalties.

- With inclusionary investing, there’s the hazard that you just mis-identify the businesses able to doing good, and flood these firms with an excessive amount of capital. Not solely is capital invested in these firms wasted, however will increase the limitations to higher options to doing good.

- With exclusionary investing, pushing costs down under their “truthful” values will allow traders who don’t care about influence to earn increased returns, from proudly owning these firms. Extra importantly, if it really works at lowering funding from public firms in a “unhealthy” enterprise, it is going to open the door to personal traders to fill the enterprise void.

- With evangelist investing, an absence of allies amongst different shareholders will imply that your makes an attempt to alter the course of companies can be largely unsuccessful. Even when you’re profitable in dissuading these firms from “unhealthy” investments, however could not have the ability to cease them from returning the money to shareholders as dividends and buybacks, quite than making “good” investments.

Within the desk under, I take a look at the potential for perverse outcomes underneath every of three influence investing approaches, utilizing local weather change influence investing as my illustrative instance:

The query of whether or not influence investing has helpful or perverse results is an empirical query, not a theoretical one, since your assumptions about market depth, investor habits and enterprise responses can lead you to totally different conclusion.

It’s price noting that influence investing could don’t have any impact on inventory costs or on company habits, both as a result of there is just too little cash behind it, or as a result of there’s offsetting investing within the different route. In these instances, influence investing is much less about impacting society and extra about assuaging the guilt and cleaning the consciences of the influence traders, and the one actual influence can be on the returns that they earn on their portfolios.

The Affect of Affect Investing: Local weather Change

Whereas influence investing may be directed at any of society’s ills, it’s plain that its greatest focus in recent times has been on local weather change, with tons of of billions of {dollars} directed at reversing its results. Local weather change, in some ways, can be tailor-made to influence investing, since considerations about local weather change are extensively held and lots of the companies which are seen pretty much as good or unhealthy, from a local weather change perspective, are publicly traded. As an empirical query, it’s price analyzing how influence investing has affected the market perceptions and pricing of inexperienced vitality and fossil gas firms, the working selections at these firms, and most critically, on the how we produce and devour vitality.

Fund Flows

The largest successes of local weather change influence investing have been on the funding aspect. Not solely has influence investing directed massive quantities of capital in the direction of inexperienced and various vitality investments, however the motion has additionally succeeded in convincing many fund managers and endowments to divest themselves of their investments in fossil gas firms.

- As considerations about local weather change have risen, the cash invested in various vitality firms has expanded, with $5.4 trillion cumulatively invested within the final decade:

|

| Supply: BloombergNEF |

Nearly half of this funding in various vitality sources has been in renewable vitality, with electrified transport and electrified warmth accounting for a big portion of the remaining investments.

- On the divestment aspect, the drumbeat towards fossil gas investing has had an impact, with many funding fund managers and endowments becoming a member of the divestiture motion:

By 2023, near 1600 establishments, with greater than $40 trillion of funds underneath their administration, had introduced or concluded their divestitures of investments in fossil gas firms.

If influence investing have been measured fully on fund flows into inexperienced vitality firms and out of fossil gas firms, it has clearly succeeded.

Market Worth (and Capitalization)

It’s plain that fund flows into or out of firms impacts their inventory costs, and if the numbers within the final part are even near actuality, it is best to have anticipated to see a surge in market costs at various vitality firms, because of funds flowing into them, and a decline in market costs of fossil gas firms, as fossil gas divestment gathers steam.

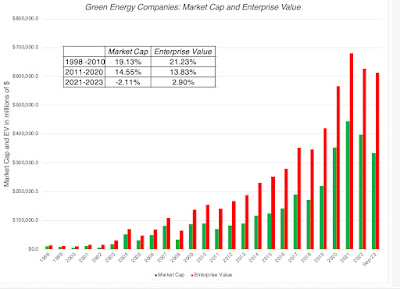

- On the choice vitality entrance, as cash has flowed into these firms, there was a surge in enterprise worth (fairness and web debt) and market capitalization (fairness worth); I report each as a result of influence investing also can take the type of inexperienced bonds, or debt, at these firms. The enterprise worth of publicly traded various vitality firms has risen from near zero twenty years in the past to greater than $700 billion in 2020, earlier than dropping steam within the final three years:

Including within the worth of personal firms and start-ups on this house would undoubtedly push up the quantity additional.

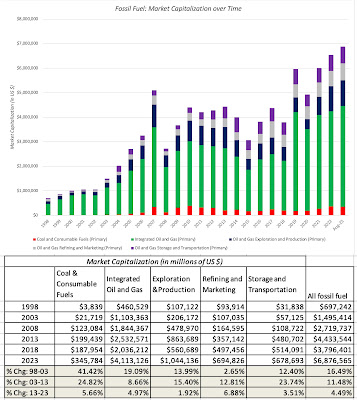

- On the fossil gas entrance, the fossil gas divestments have had an influence on market capitalizations, although there are indicators that the impact is weakening:

Within the final decade, when fossil gas divestment surged, the proportion adjustments in market capitalization at fossil gas firms lagged returns available on the market, with fossil gas firms reporting a compounded annual proportion improve of 4.49% a 12 months.. The unfavorable impact was strongest in the midst of the final decade, however market costs for fossil gas firms have recovered strongly between 2020 and 2023.

It’s price noting that even after their surge in market cap within the final decade, various vitality firms have a cumulated enterprise worth of about $600 billion in September 2023, a fraction of the $8.5 trillion of cumulated enterprise worth at fossil gas firms.

Investor perceptions

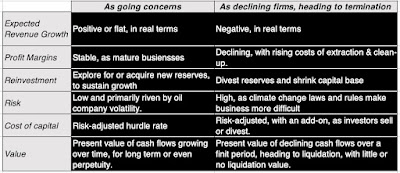

Affect investing has all the time been about altering investor perceptions of vitality firms, extra than simply costs. Actually, some influence traders have argued that their presence available in the market and advocacy for various vitality has led traders to alter their views about fossil gas firms, shifting from viewing them as worthwhile, cash-rich companies with prolonged lives, to firms residing on borrowed time, taking a look at decline and even demise. In intrinsic valuation phrases, that shift ought to present up within the pricing, with decrease worth connected to the latter situation than the previous:

On the inexperienced vitality entrance, to see if traders perceptions of those firms have modified, I take a look at two the pricing metrics for inexperienced vitality firms – the enterprise worth to EBITDA and enterprise worth to income multiples:

The numbers provide a blended message on whether or not influence investing has modified investor perceptions, with EV to EBITDA multiples staying unchanged, between the 1998-2010 and 2011-2023 time intervals, however EV as a a number of of revenues hovering from 2.62 within the 1998-2010 time interval to five.95 within the 2011-2023 time interval. The fund flows into inexperienced vitality are affecting pricing, although it stays an open query as as to whether the pricing is getting too wealthy, as an excessive amount of cash chases too few alternatives.

Taking a look at fossil gas companies, the poor efficiency within the final decade appears to assist the notion that influence investing has modified how traders understand fossil gas firms, however there are some checks that have to be run to come back that conclusion.

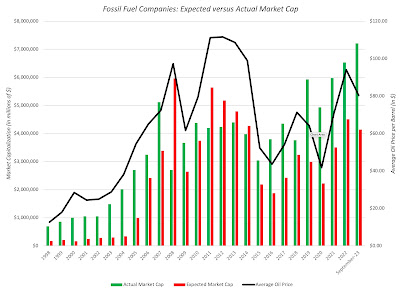

- Oil Worth Impact: The market capitalization of oil firms relies on oil costs, as you possibly can see within the determine under, the place the collective market capitalization of fossil gas firms is graphed towards the common oil worth annually from 1970 to 2022; nearly 70% of the variation in market capitalization over time defined by oil worth actions.

To separate influence investing divestment results from oil worth results, I estimated the anticipated market capitalization of fossil gas firms, given the oil worth annually, utilizing the statistical relationship between market cap and oil costs within the twenty 5 years main into the forecast 12 months. (I regress market capitalization towards common oil worth from 1973 to 1997 to estimate the anticipated market cap in 1998, given the oil worth in 1998, and so forth, for yearly from 1998 to 2023. Be aware that the one factor you possibly can learn these regressions is that market capitalization and oil costs transfer collectively, and that there isn’t any method to attract conclusions about causation):

If divestitures are having a scientific impact on how markets are pricing fossil gas firms, it is best to anticipate to see the precise market capitalizations trailing the anticipated market capitalization, primarily based on the oil worth. That appears to be the case, albeit marginally, between 2011 and 2014, however not since then. Briefly, the divestiture impact on fossil gas firms has light over time, with different traders stepping in and shopping for shares of their firms, drawn by their earnings energy.

- Pricing: If influence investing is altering investor perceptions in regards to the future progress and termination danger at fossil gas firms, it ought to present up in how these firms are priced, decreasing the multiples of revenues or earnings that traders are prepared to pay. Within the chart under, I take a look at the pricing of fossil gas firms over time, utilizing EV to gross sales and EV to EBITDA as pricing metrics:

Whereas the pricing metrics swing from 12 months to 12 months, that has all the time been true at oil firms, since earnings and revenues fluctuate, with oil costs. Nonetheless, if influence investing is having a scientific impact on how traders are pricing firms, there’s little proof of that on this chart.

In sum, whereas it’s doable to seek out particular person traders who’ve develop into skeptical in regards to the future for fossil gas firms, that view will not be reflective of the market consensus. I do imagine that traders are pricing fossil gas firms now, with the expectation of a lot decrease progress sooner or later, than they used to, however that’s coming as a lot from these firms returning extra of their earnings as money and reinvesting lower than they used to, as it’s from an expectation that the times of fossil gas are numbered. Some influence traders will argue that it’s because traders are short-term, however that could be a double-edged sword, because it undercuts the very thought of utilizing investing because the automobile to create social and environmental change.

Working Affect

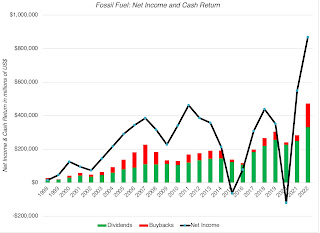

Affect investing, along with affecting pricing of inexperienced vitality and fossil gas firms, also can have an affect on how fossil gas firms carry out and function. On the profitability entrance, fossil gas firms appear to have weathered the onslaught of local weather change critics, with revenues and revenue margins (EBITDA and working) bouncing bacokay from a stoop between 2014 and 2018 to achieve historic highs in 2022.

A key growth over the past decade, as income have returned, is that fossil gas firms are returning a lot of money flows that they’re producing to their shareholders within the type of dividends and buybacks, however the stress from activist influence traders that they reinvest that cash in inexperienced vitality tasks:

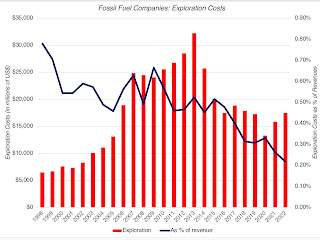

In a single growth that influence traders could welcome, fossil gas firms are collectively investing much less in exploration for brand new fossil gas reserves within the final decade than they did in prior ones:

If you happen to couple this pattern of exploring much less with the divestitures of fossil gas reserves, over the past decade, there’s a foundation for the argument that fossil gas firms are lowering their fossil gas presence, and a few influence investing advocates could also be tempted to declare victory. In any case, if the target is to cut back fossil gas manufacturing, does it not advance your trigger if much less cash is being spent exploring for coal, oil and fuel?

|

| Supply: Pitchbook |

Macro Affect

The success or failure of influence investing, when it pertains to local weather change, finally comes from the adjustments it creates in how vitality is produce and consumed, and it’s on this entrance that the futility of the motion is most seen. Whereas various vitality sources have expanded their manufacturing, it has not been on the expense of oil consumption, which has barely budged over the past decade.

Pretty or unfairly, the pandemic appears to have executed extra to curb oil consumption than all of influence investing’s efforts over the past decade, however the COVID impact, which noticed oil consumption drop in 2020 has largely light.

Taking a worldwide and big-picture perspective of the place we get our vitality, a comparability of vitality sources in 1971 and 2019 yields an image of how little issues have modified:

Fossil gas, which accounted for 86.6% of vitality manufacturing in 1971, was chargeable for 80.9% of manufacturing in 2019, with nearly all of that acquire from coming from nuclear vitality, which many influence traders seen as an undesirable various vitality supply for a lot of the final decade. Specializing in vitality manufacturing simply within the US, the failure of influence investing to maneuver the needle on vitality manufacturing may be seen in stark phrases:

Fossil fuels account for a better % of total vitality produced in the US at this time than they did ten or fifteen years in the past, with features in photo voltaic, wind and hydropower being largely offset by reductions in nuclear vitality. If that is what passes for profitable in influence investing, I’d hate to see what dropping appears to be like like.

I’ve tried out variants of this submit with influence investing acquaintances, and there are three broad responses that they need to its findings (and three defenses for why we must always hold attempting):

- Issues could be worse with out influence investing: It’s unimaginable to check this hypothetical, however is it doable that our dependence on fossil fuels could be even larger, with out influence investing making a distinction? In fact, however that argument could be simpler to make, if the pattern traces have been in the direction of fossil fuels earlier than influence investing, and moved away from fossil fuels after its rise. The information, although, means that the most important shift away from fossil fuels occurred many years in the past, properly earlier than influence investing was round, primarily from the rise of nuclear vitality, and that influence investing’s tunnel imaginative and prescient on various vitality has truly made issues worse.

- It takes time to create change: It’s true that the vitality enterprise is an infrastructure enterprise, requiring massive investments up entrance and lengthy gestation intervals. It’s doable that the consequences of influence investing are simply not being felt but, and that they’re prone to present up later this decade. This is able to undercut the urgency argument that influence traders have used to induce their shoppers to speculate massive quantities and doing it now, and if that they had been extra open in regards to the time lag from the start, this argument would have extra credibility at this time.

- Investing can not offset consumption decisions: If the argument is that influence investing can not stymie local weather change by itself, with out adjustments in shopper habits, I couldn’t agree extra, however altering habits can be painful, each politically and economically. I’d argue that influence investing, by providing the false promise of change on a budget, has truly decreased the stress on politicians and rule-makers to make arduous selections on taxes and manufacturing.

Even conceding some fact in all three arguments, what I see within the knowledge is the essence of madness, the place influence traders hold throwing in more money into inexperienced vitality and extra vitriol at fossil fuels, whereas the worldwide dependence on fossil fuels will increase.

Affect Investing: Investing for change

A lot of what I’ve stated about influence investing’s quest to combat local weather change may be stated in regards to the different societal issues that influence traders attempt to handle. Poverty, sexism, racism and inequality have had influence investing {dollars} directed at them, albeit not on the identical scale as local weather change, however are we higher off as a society on any of those dimensions? To the response that doing one thing is healthier than being doing nothing, I urge to vary, since performing in ways in which create perverse outcomes may be worse than sitting nonetheless. To finish this submit on a hopeful word, I imagine that influence investing may be rescued, albeit in a humbler, extra modest kind.

- With your personal cash, move the sleep check: If you’re investing your personal cash, your investing ought to replicate your pocketbook in addition to your conscience. In any case, traders, when selecting what to spend money on, and the way a lot, need to move the sleep test. If investing in Exxon Mobil or Altria leads you to lose sleep, due to guilt, it is best to keep away from investing in these firms, irrespective of how good they appear on a monetary return foundation.

- With different individuals’s cash, be clear and accountable about influence: If you’re investing different individuals’s cash, and aiming for influence, you’ll want to be specific on what the issue is that you’re attempting to resolve, and get purchase in from those that are investing with you. As well as, it is best to specify measurement metrics that you’ll use to guage whether or not you might be having the influence that you just promised.

- Be sincere about commerce offs: When investing your personal or different individuals’s cash, you must be sincere with your self not solely in regards to the influence that you’re having, however in regards to the commerce offs implicit in influence investing. As somebody who teaches at NYU, I imagine that NYU’s current determination to divest itself of fossil fuels is not going to solely don’t have any impact on local weather change, however coming from an establishment that has established a vital presence in Abu Dhabi, it’s an act of rank hypocrisy. It’s also crucial that these influence traders who anticipate to make risk-adjusted market returns or extra, whereas advancing social good, acknowledge that being good comes with a value.

- Much less absolutism, extra pragmatism: For these influence traders who cloak themselves in advantage, and act as in the event that they command the ethical excessive floor, simply cease! Not solely do you alienate the remainder of the world, along with your I-care-about-the-world-more-than-you perspective, however you remove any probabilities of studying from your personal errors, and altering course, when your actions do not work.

- Harness the revenue motive: I do know that for some influence traders, the revenue motive is a grimy idea, and the basis motive for the social issues that influence investing is attempting to handle. Whereas it’s true that the pursuit of income could underlie the issue that you’re attempting to resolve, the ability from harnessing the revenue motive to resolve issues is immense. Agree along with his strategies or not, Elon Musk, pushed much less by social change and extra by the will to create essentially the most invaluable firm on this planet, has executed extra to handle local weather change than all of influence investing put collectively.

I began this submit with two presumptions, that the social issues being addressed by influence traders are actual and that influence traders have good intentions, and if that’s certainly the case, I feel it’s time that influence traders face the reality. After 15 years, and trillions invested in its title, influence investing, as practiced now, has made little progress on the social and environmental issues that it purports to resolve. Is it not time to attempt one thing totally different?

YouTube Video

ESG Posts